Import External Funds

1. Project Overview

The Consolidated Account Statement Import feature aimed to streamline the process of importing client external funds into Mint's app for both brokers and clients. By integrating this functionality, Mint sought to:

- Enhance usability by offering a seamless import process within the app.

- Align the app’s functionality with the existing web-based system.

- Improve the management of client portfolios by enabling direct imports and mapping of financial data.

2. Problem Statement

- Fragmented Process: Users had to rely on the web platform for CAS imports, limiting the app's utility.

- Manual Errors: Inconsistent data inputs (e.g., incorrect PAN or email/mobile combinations) caused delays.

- Rejection Bottlenecks: Unmapped schemes and transaction types created inefficiencies.

- Limited Client Autonomy: Clients often needed brokers to resolve data mapping issues.

- Lack of Real-Time Notifications: Users were not updated on the status of imports, resulting in confusion.

3. Research Insights

- Stakeholder Interviews: Brokers, RMs, sub-brokers, family heads, and investors shared their expectations.

- Journey Mapping: Tracked the end-to-end CAS import process to identify pain points.

- Feedback Analysis: Reviewed user feedback from the web platform to incorporate lessons into the app design.

Key Insights:

- Users demanded real-time updates on import status to reduce dependency on manual follow-ups.

- Brokers needed tools for rejection mapping to streamline scheme and transaction type corrections.

- Clients valued the ability to independently initiate imports, provided adequate error handling and guidance were in place.

4. Design Goals

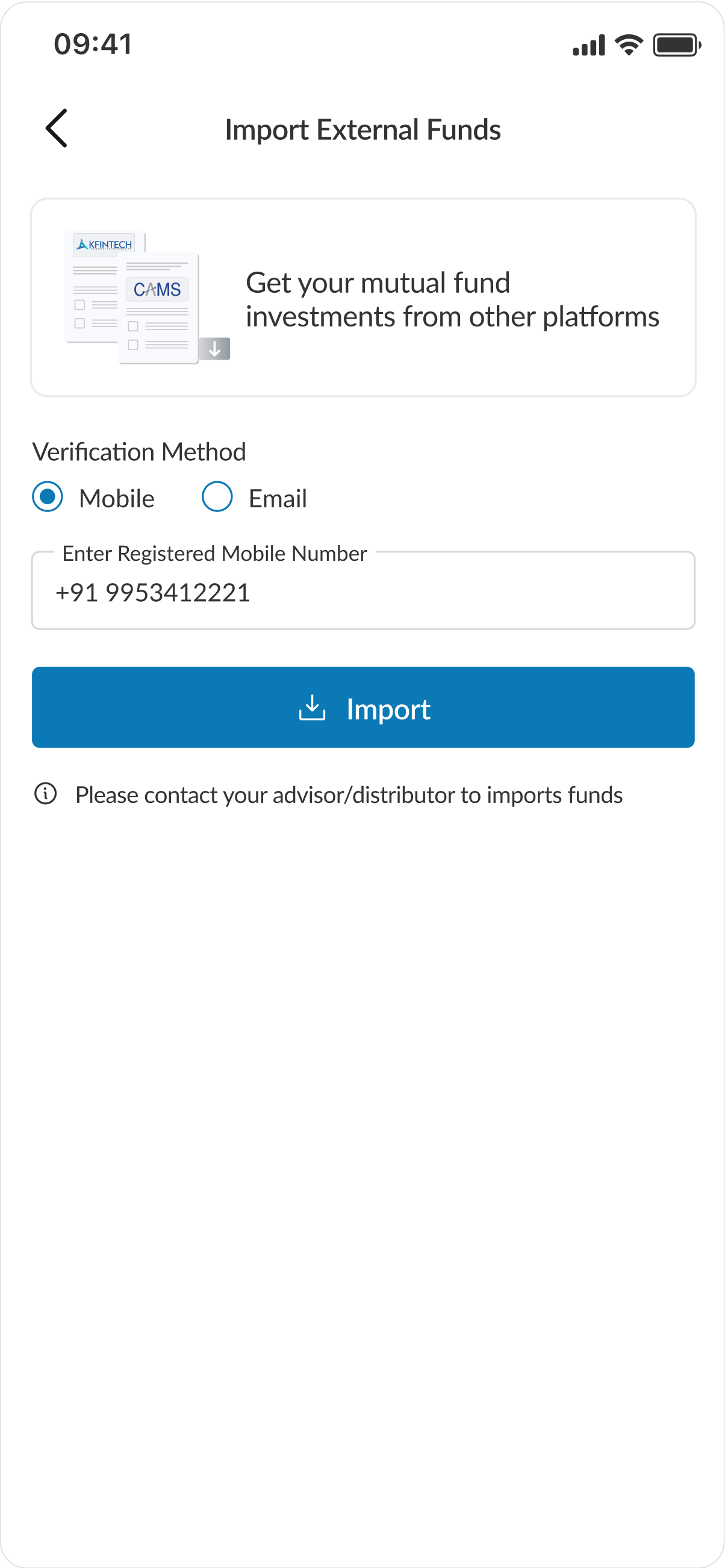

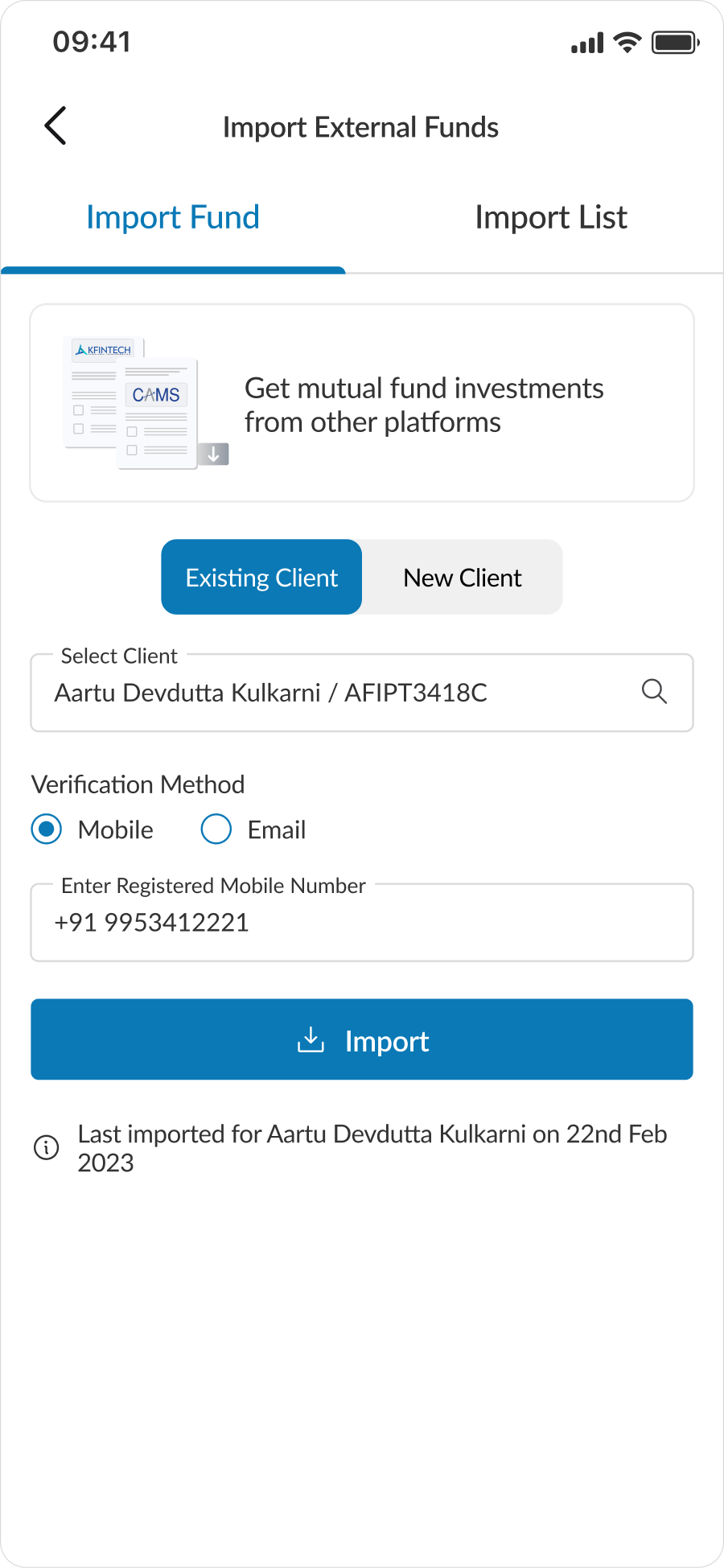

- Seamless Import Workflow: Enable a user-friendly CAS import process with clear steps and validations.

- Error Handling: Offer actionable feedback for common errors (e.g., invalid PAN-email/mobile combinations).

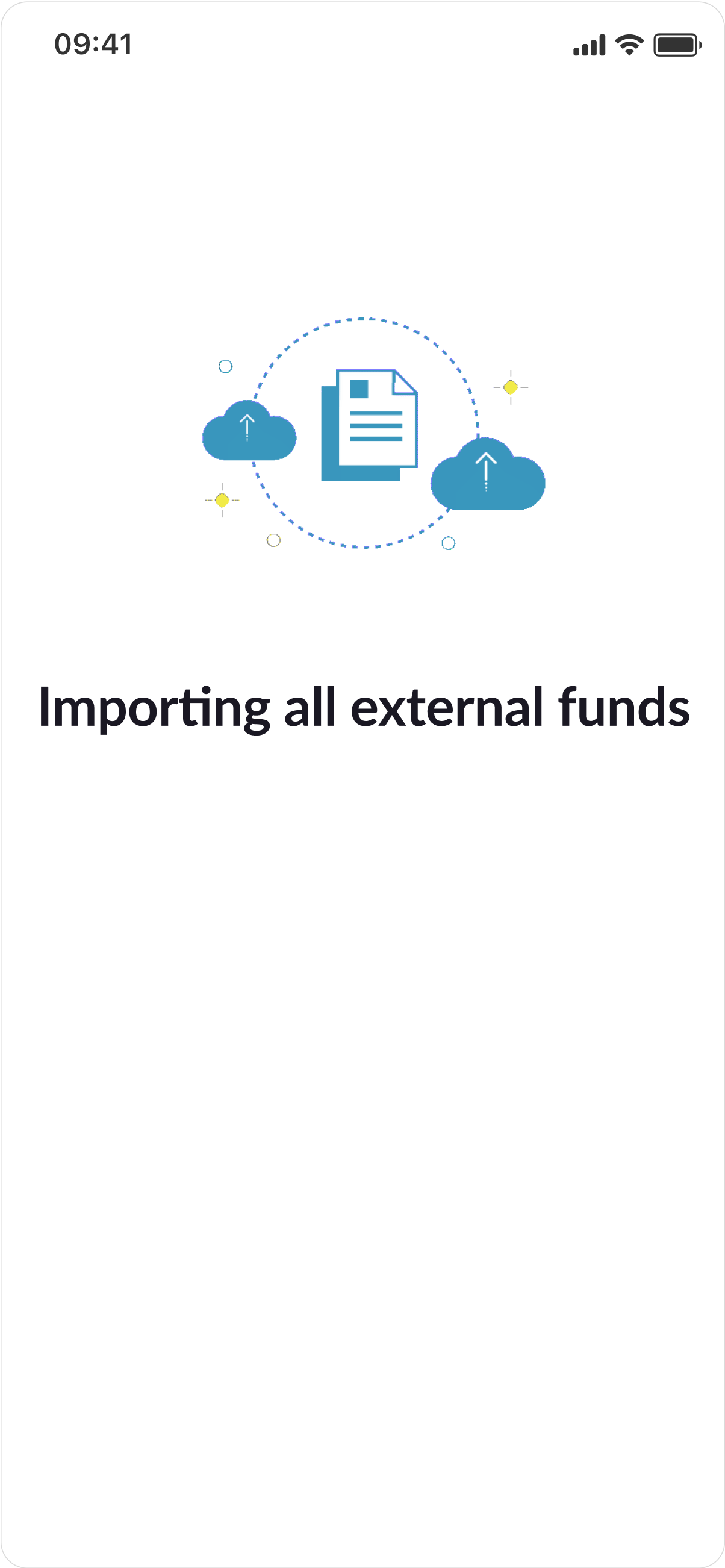

- Status Transparency: Provide real-time updates on the import process for both brokers and clients.

- Efficient Rejection Mapping: Simplify scheme and transaction type mapping to minimize delays.

- Feature Parity: Ensure consistency between the app and web versions of the CAS import feature.

5. The Solution

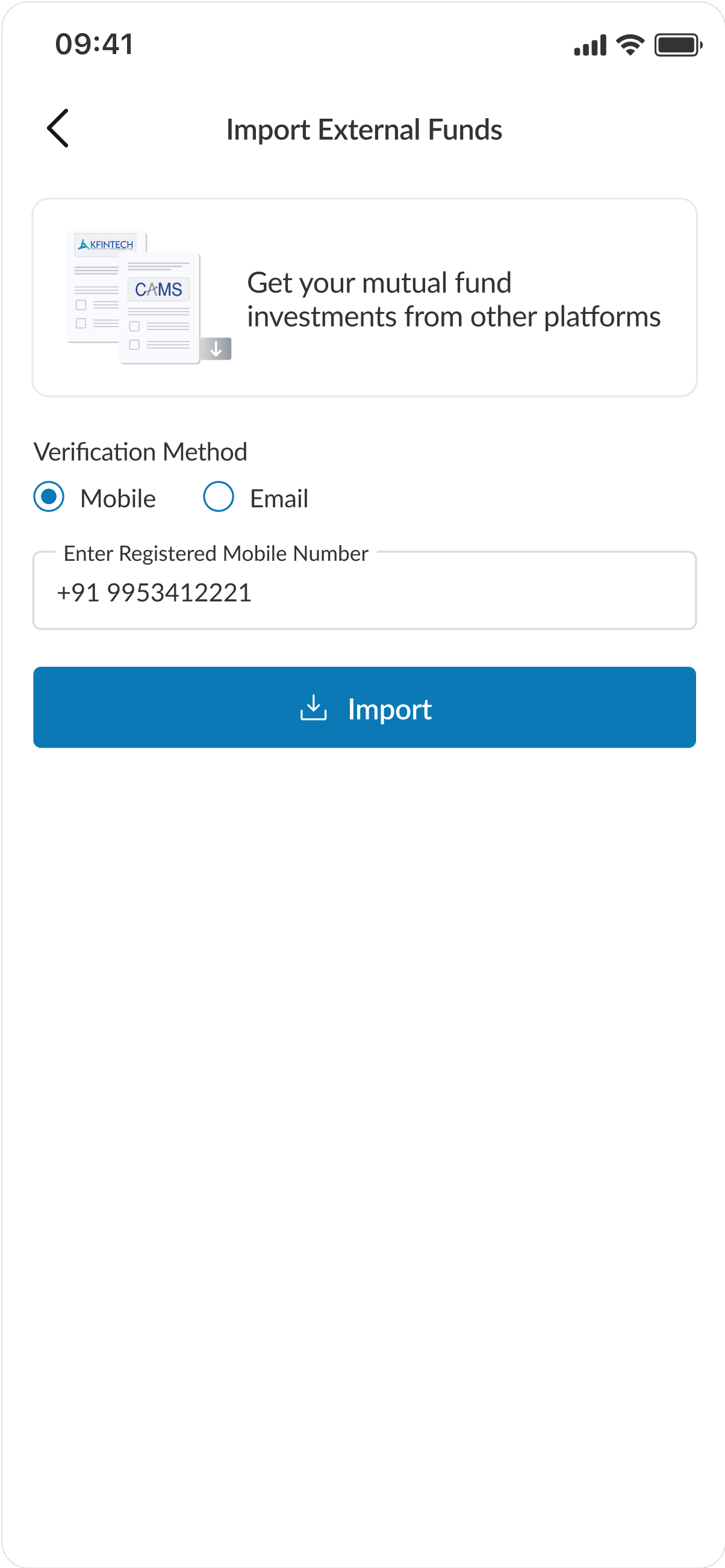

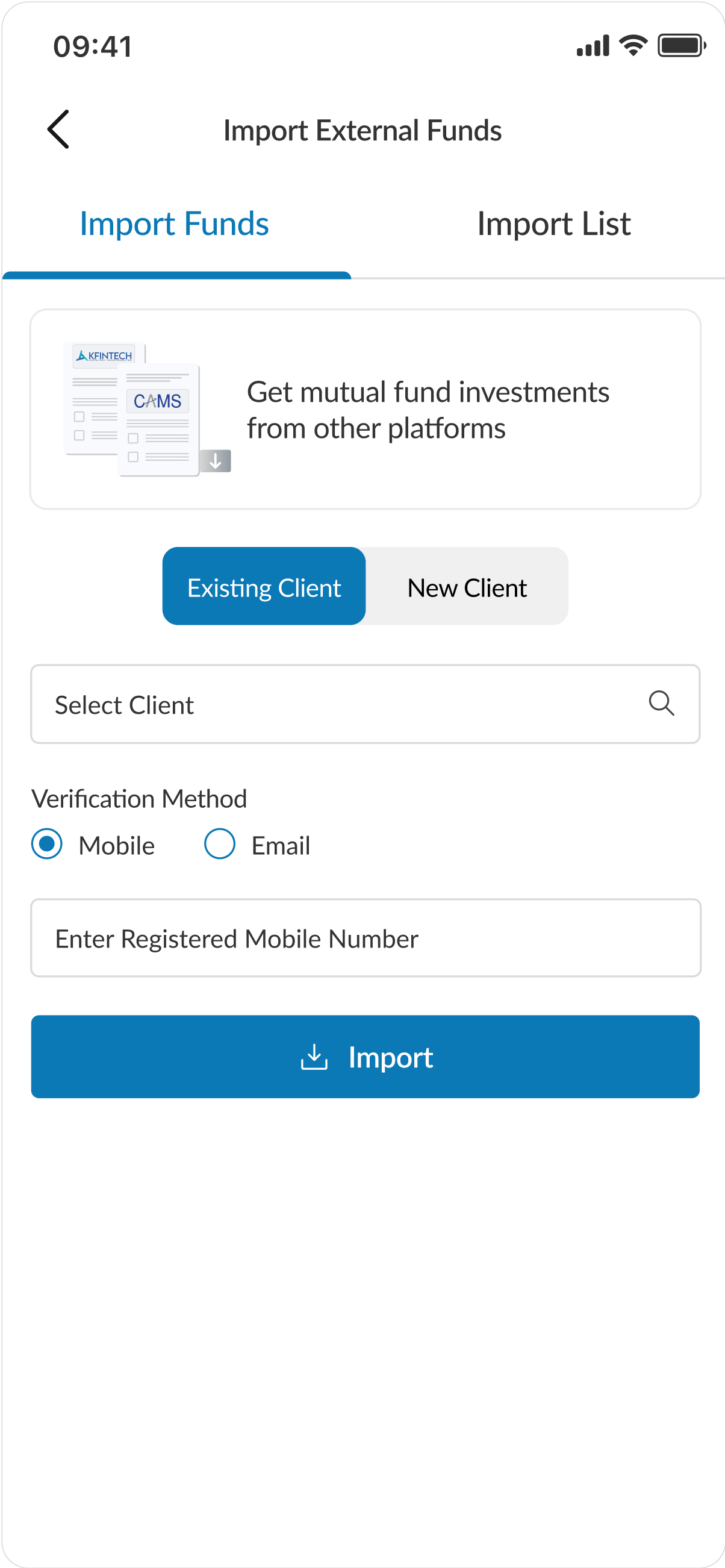

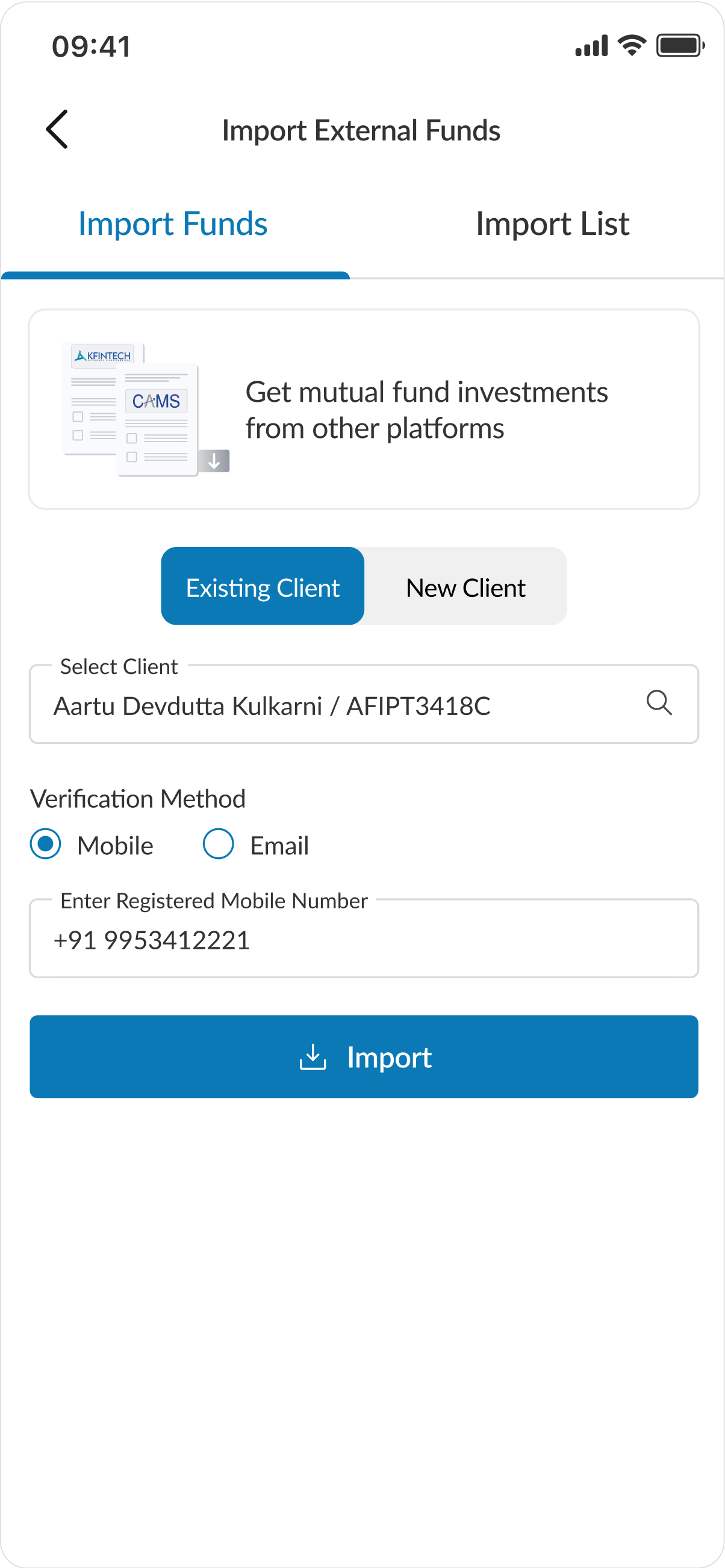

A. Unified Import Workflow

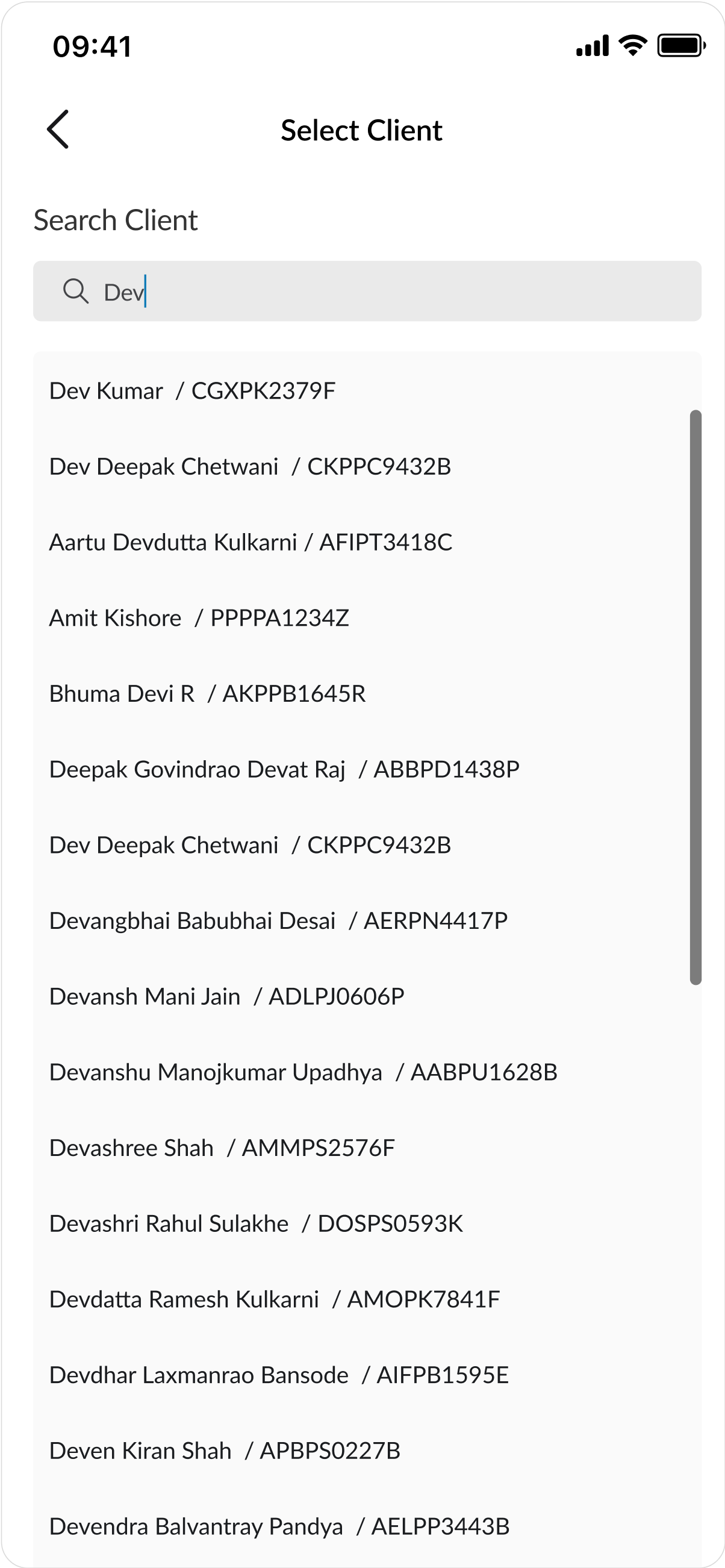

- For Existing Clients: Users select from their client list, with pre-filled contact details that are editable.

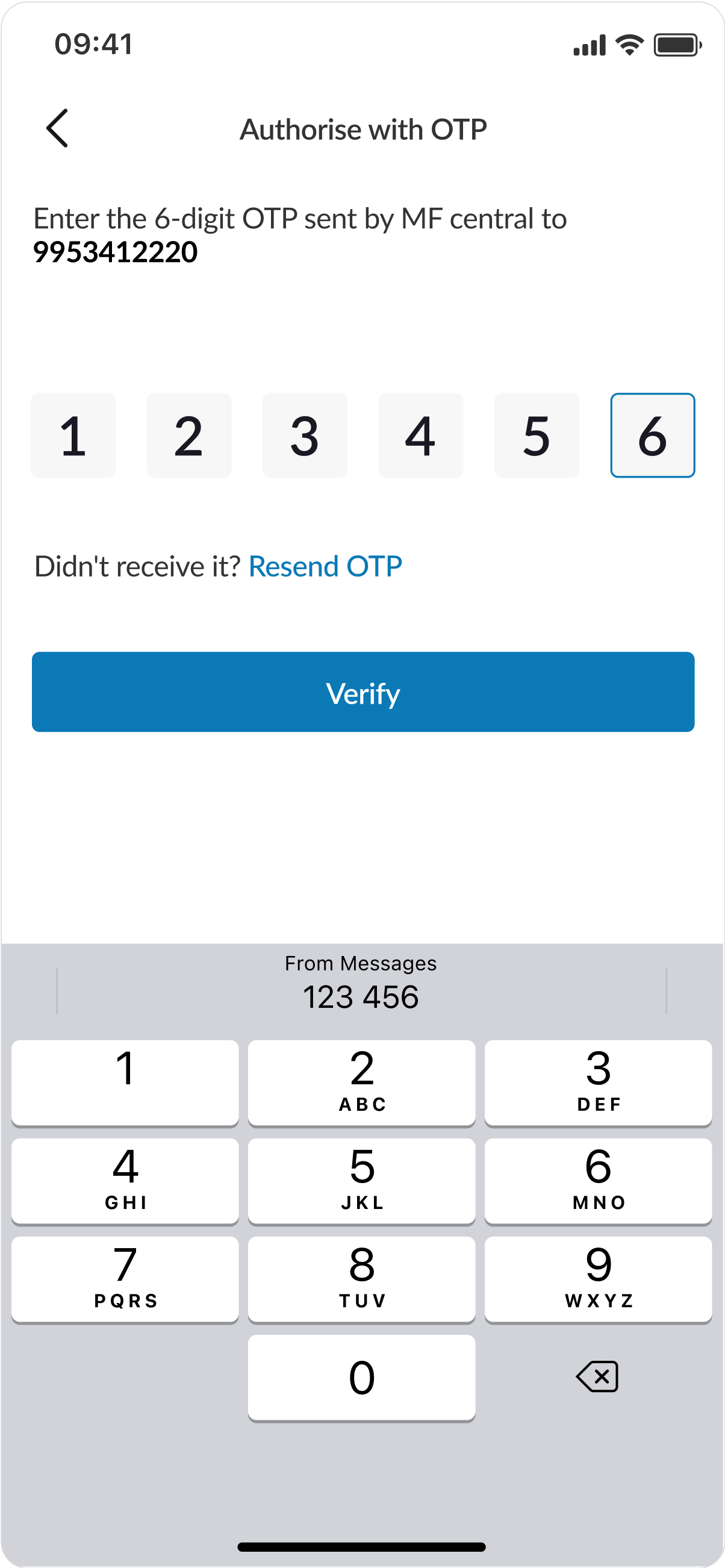

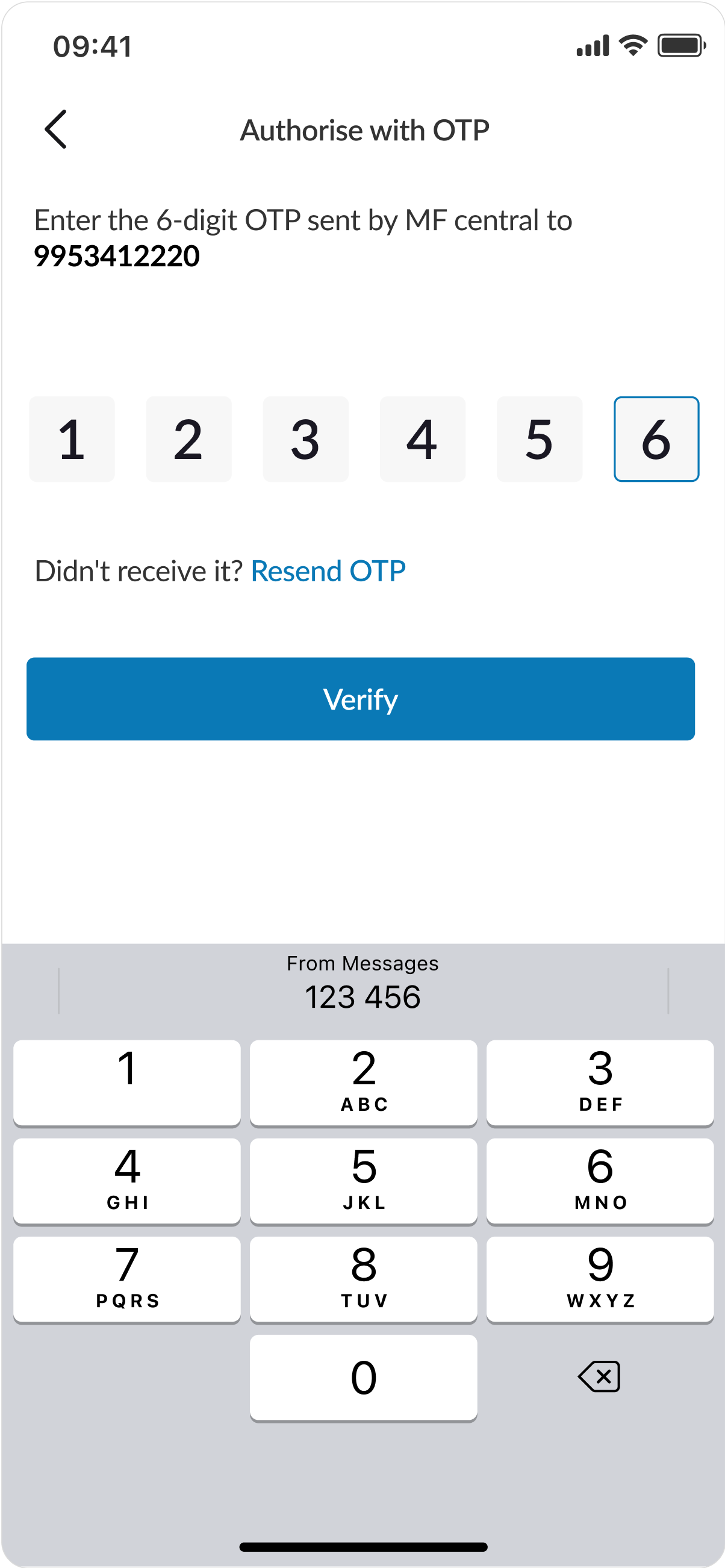

- For New Clients: Users provide the client’s PAN and contact details. Upon OTP validation, new clients are added to the broker’s system.

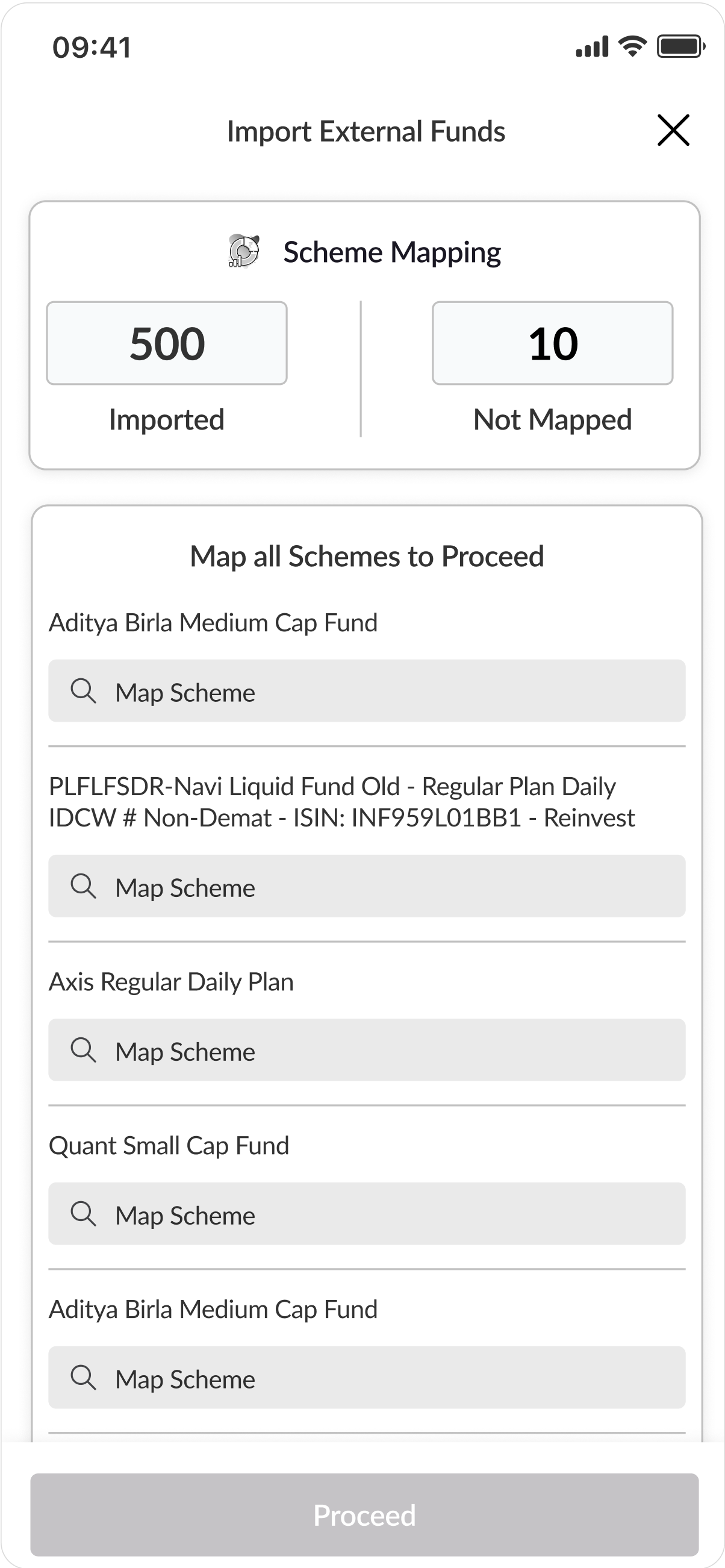

B. Rejection Mapping

- Scheme Rejections: Lists unmapped schemes; users can map these to existing system schemes.

- Transaction Type Rejections: Allows mapping of unsupported transaction types to system-recognized types.

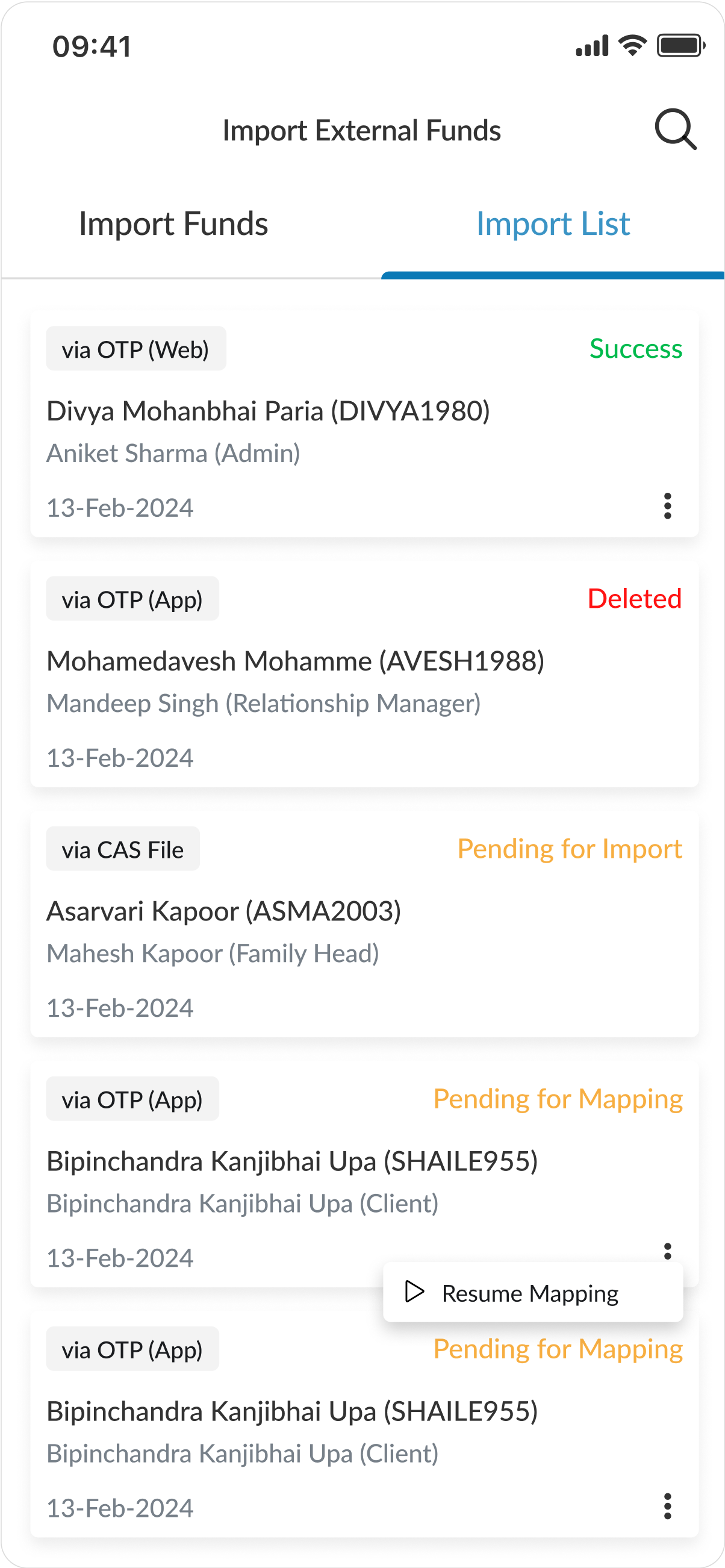

- Resume Mapping: Users can resume pending rejection mapping at any time.

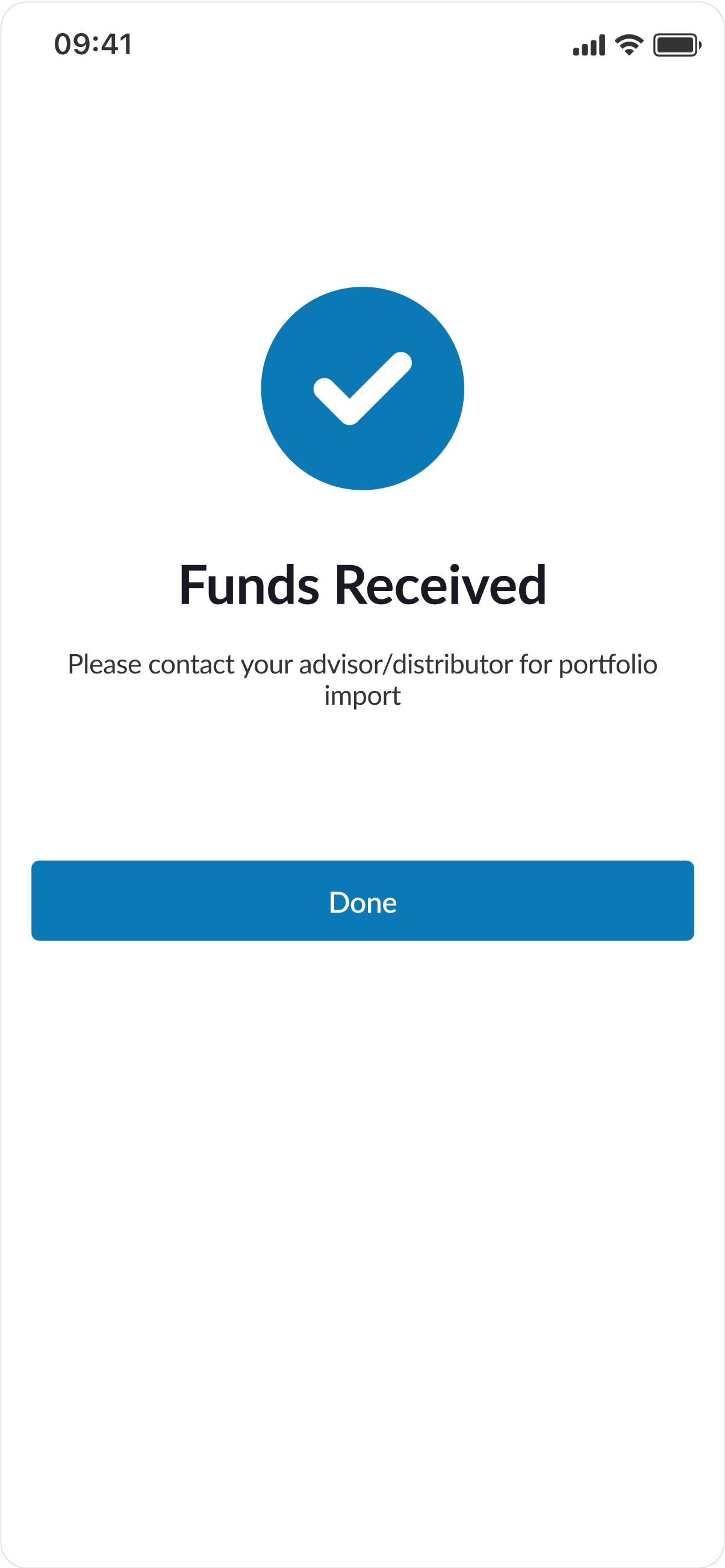

C. Import Status Management

- Status Categories: Success, Deleted, Pending for Import, Pending for Mapping.

- Real-Time Notifications: Alerts brokers and clients upon import success or errors.

D. Role-Specific Features

- Broker Portal: Full control over imports, rejection mapping, and client assignment.

- Client Portal: Family heads and investors can initiate imports with limitations.

E. Filters and Search

- By Client Name: Enables quick access to specific client imports.

- By Status: Sorts imports by completion stage.

- By Initiator: Identifies who initiated the import.

F. Notifications and Error Handling

- Notifications: Real-time updates for import status and rejection mapping resolution.

- Error Messages: Clear feedback for invalid PAN-email/mobile combinations or re-import attempts within 24 hours.

6. Visual Design

- Clean, tabular view of imports with filters and sorting options.

- Mobile Optimization: Designed for responsiveness, ensuring usability across devices.

7. Results and Impact

- 50% reduction in time spent on CAS imports due to streamlined workflows and pre-filled data fields.

- 80% of brokers transitioned from web to app imports within the first quarter post-launch.

8. Reflection and Learnings

- Real-time notifications improved transparency and user trust.

- Clear, actionable error messages significantly enhance the user experience.

9. Future Enhancements

- AI-Driven Mapping: Automate scheme and transaction type mapping using machine learning.

- Batch Imports: Allow brokers to import CAS for multiple clients simultaneously.