KYC Onboarding

KYC Onboarding

1. Setting the Scene

Imagine a new investor logging into Mint, ready to complete their KYC process. Instead of a seamless experience, they are directed to Mint’s in-house form for 30% of the process, only to be redirected to Signzy’s external portal for the remaining 70%. Once they’re done, they discover they need to re-enter the same details to create their investment profile. Frustrating, isn’t it?

This was the reality for Mint users and brokers—a fragmented, time-consuming onboarding process that hampered user engagement and operational efficiency.

2. Identifying the Problem

- User Challenges:

- Investors faced duplication of effort, entering the same information twice.

- Switching between portals was disruptive and broke user trust.

- Many dropped out mid-process due to unclear instructions or a lack of transparency.

- Broker Challenges:

- Brokers had limited visibility into application progress.

- Tracking updates required accessing multiple systems, leading to inefficiencies.

3. Our Mission

To design an integrated, seamless KYC onboarding flow that would:

- Combine all steps into Mint’s in-house form, eliminating dependency on external portals.

- Automate investment profile creation during onboarding to save time and effort.

- Provide a clear, guided experience for users while enhancing tracking capabilities for brokers.

4. Diving into Research

To truly understand the problem, we:

- Interviewed Brokers: They emphasized the need for a centralized dashboard to track applications.

- Observed User Behavior: Mapped the existing user journey and identified frustration points during transitions between Mint and Signzy.

- Analyzed Competitors: Studied KYC flows of leading platforms to identify what worked well in the industry.

- Regulatory Deep-Dive: Collaborated with compliance teams to ensure every step met industry standards for BSE, NSE, and MFU.

Key Insight: Users wanted a one-stop solution that would guide them step-by-step without requiring them to leave the platform or re-enter details.

5. Designing the Solution

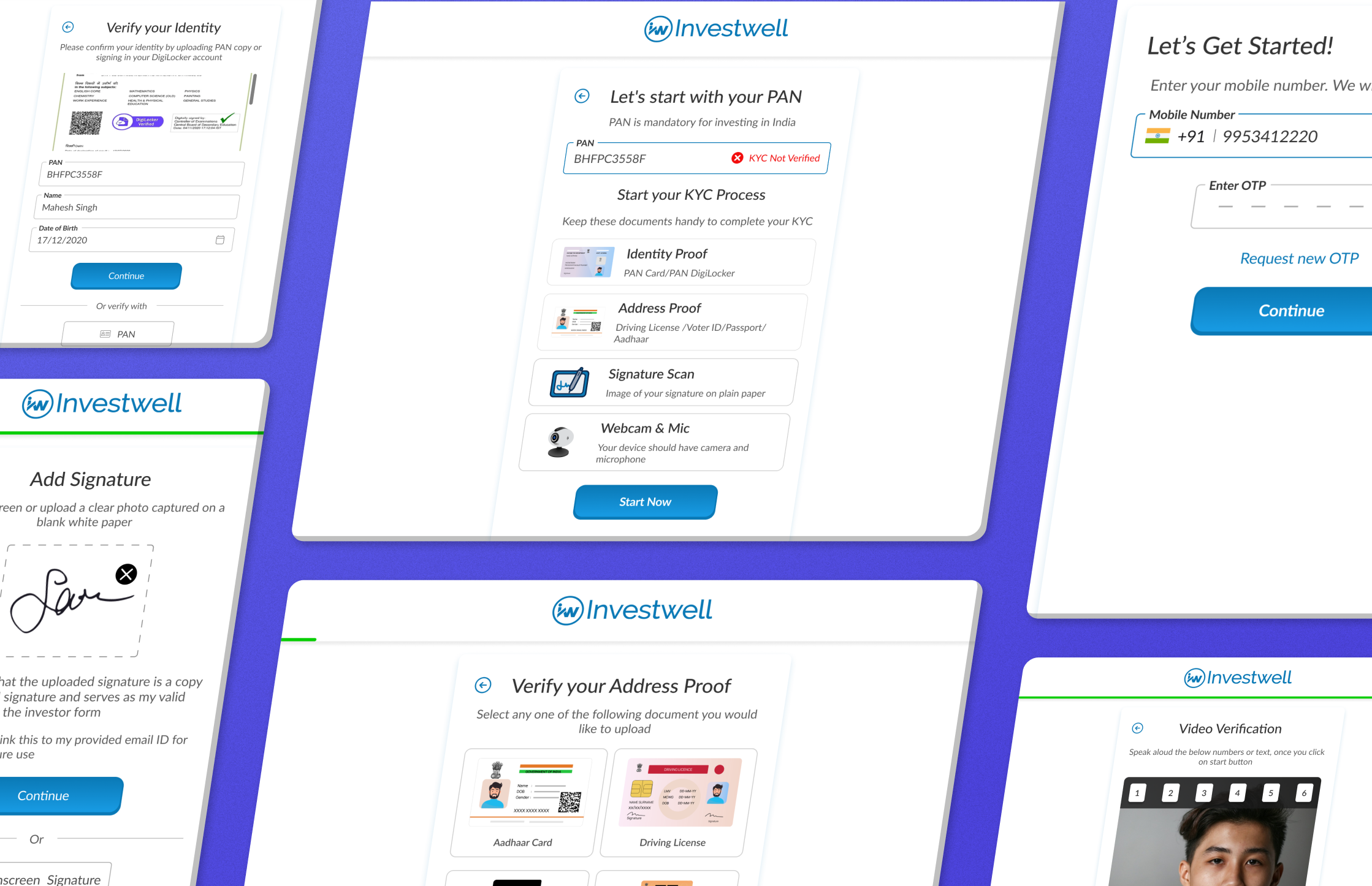

The result was a 13-step, streamlined KYC onboarding flow, fully integrated into Mint. Here’s how it worked:

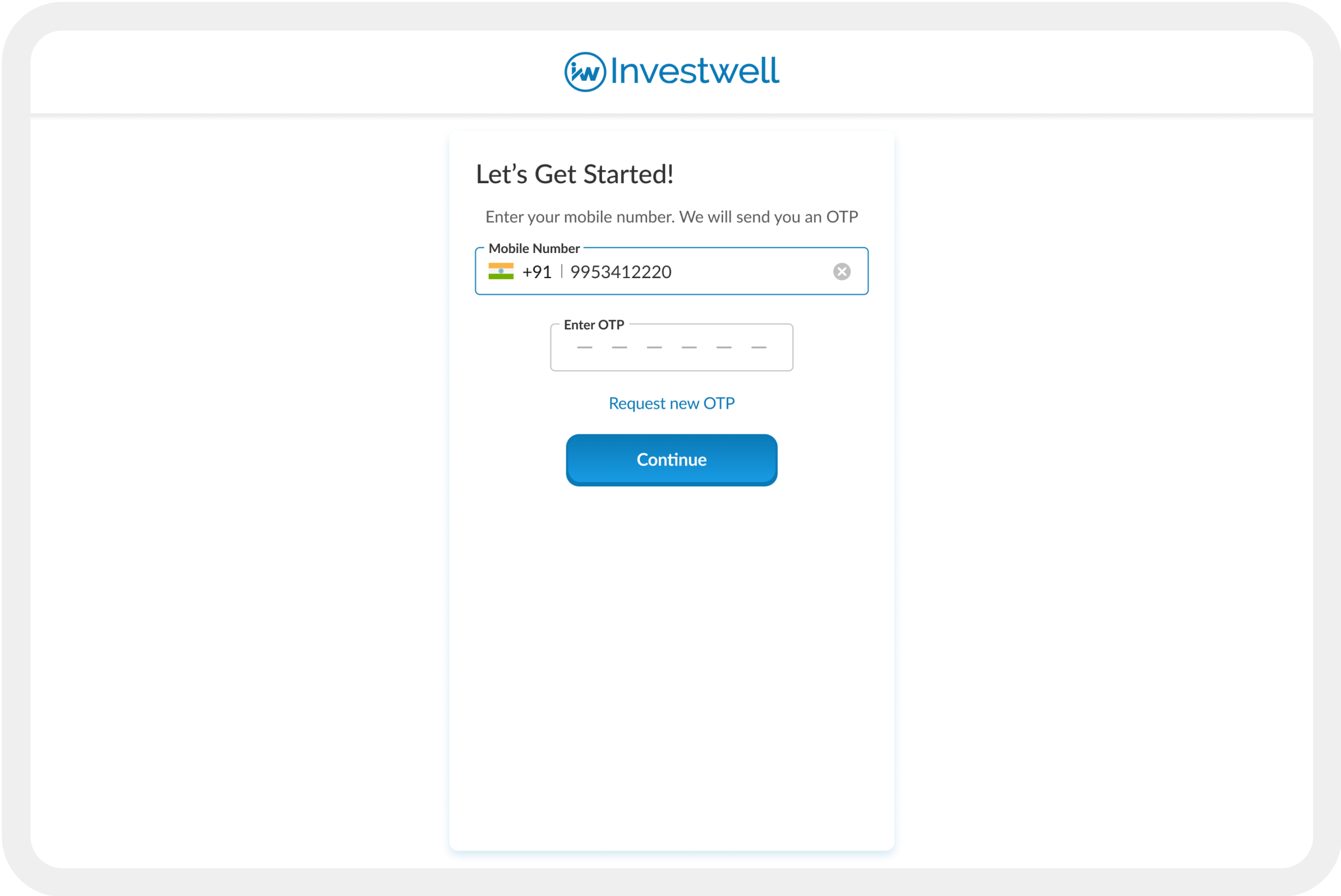

- OTP Authentication: Users began by entering their mobile number for verification.

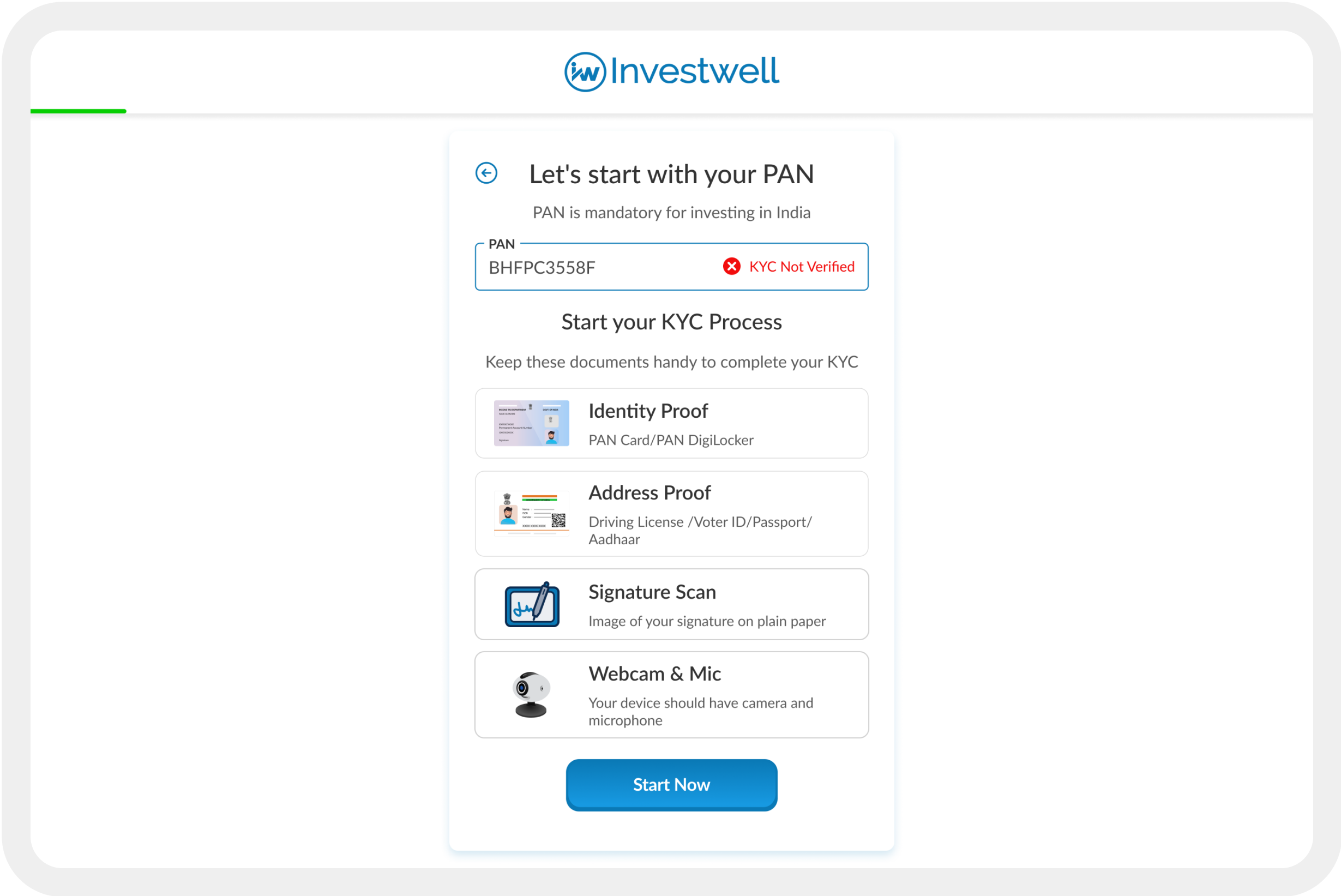

- PAN Validation: Instant checks ensured the PAN was verified, building trust.

- Preparation Guidance: Users were prompted to gather documents (e.g., Aadhaar, PAN, voter ID, canceled cheque, signature) upfront.

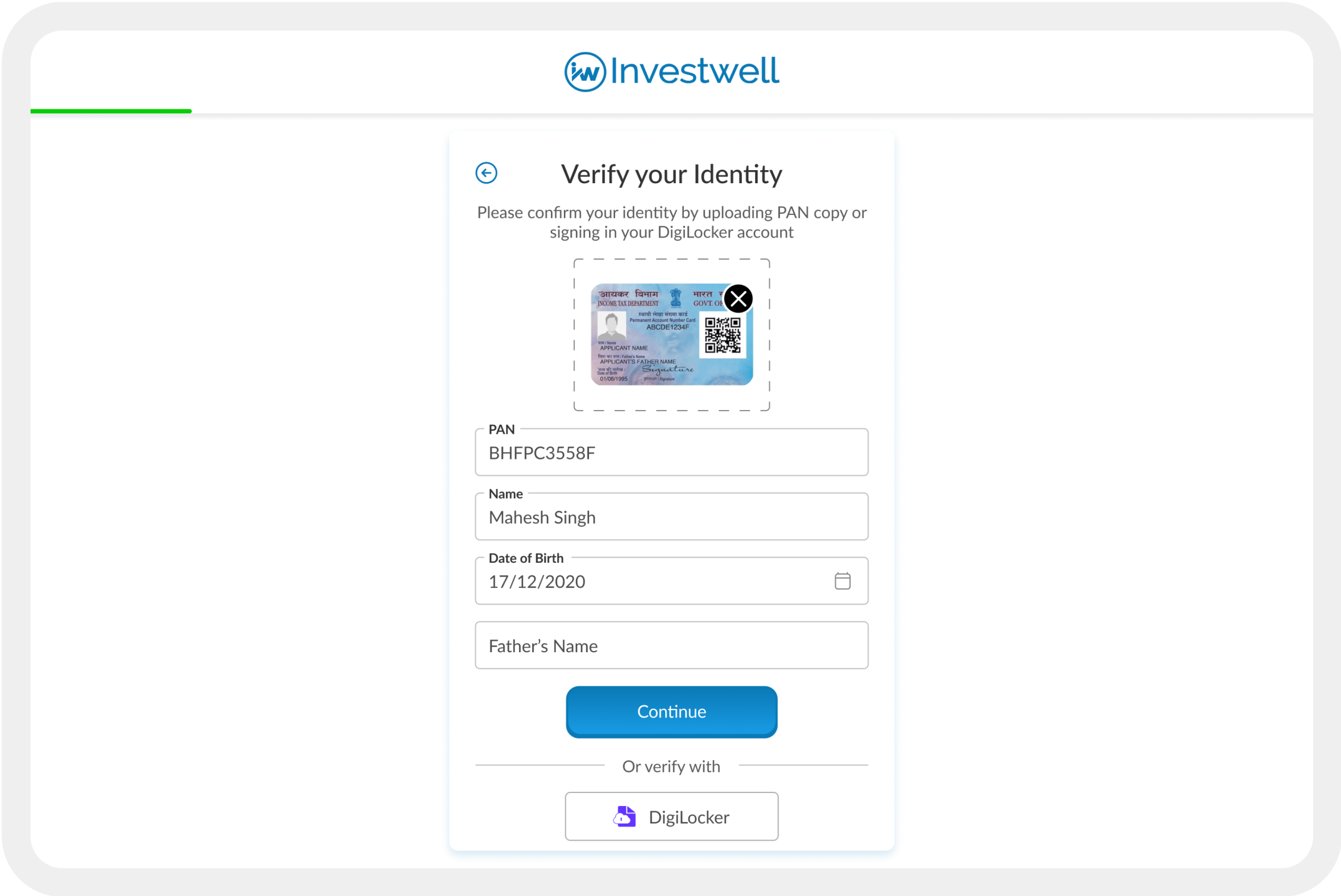

- Identity Verification: Uploading PAN or using DigiLocker simplified the process.

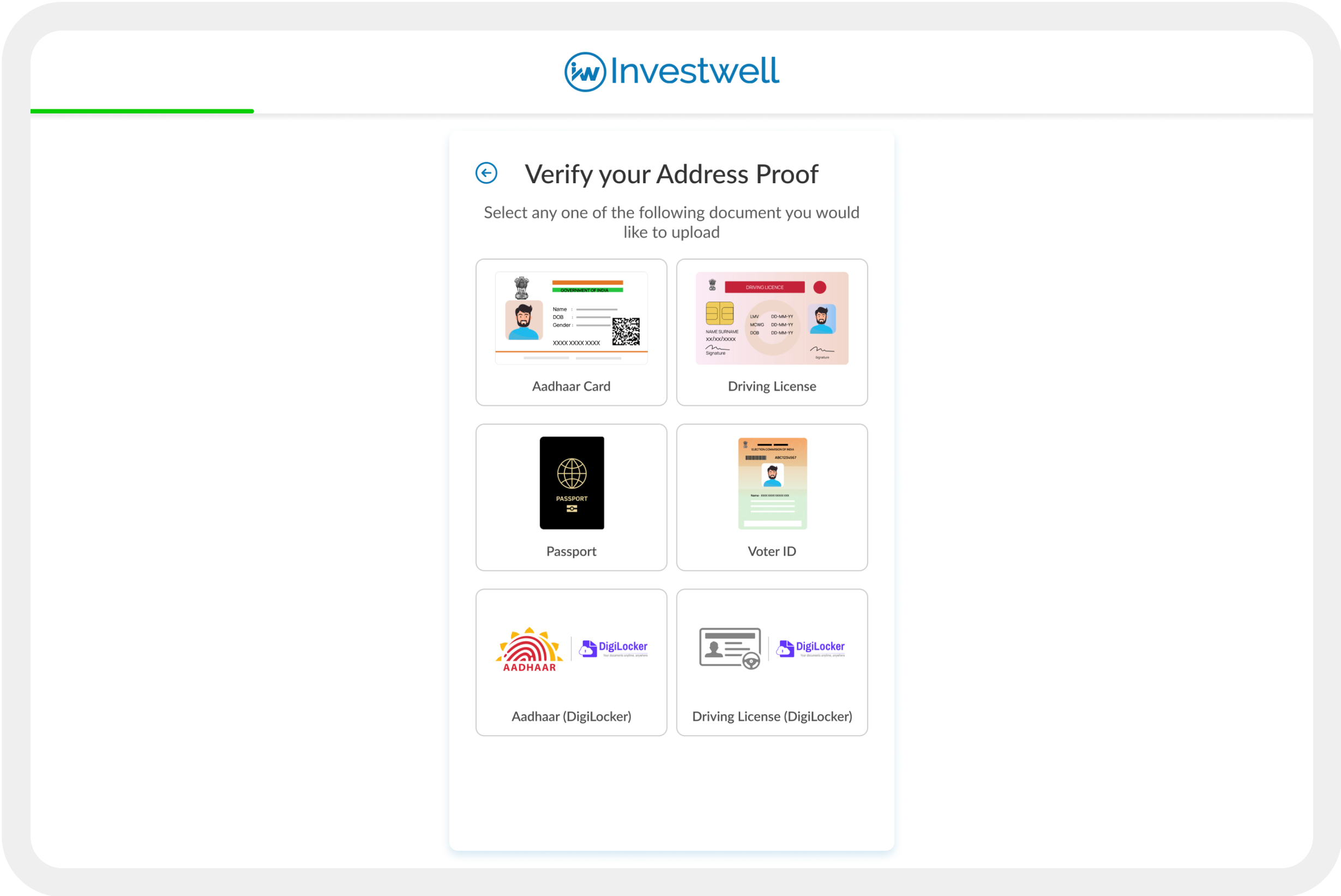

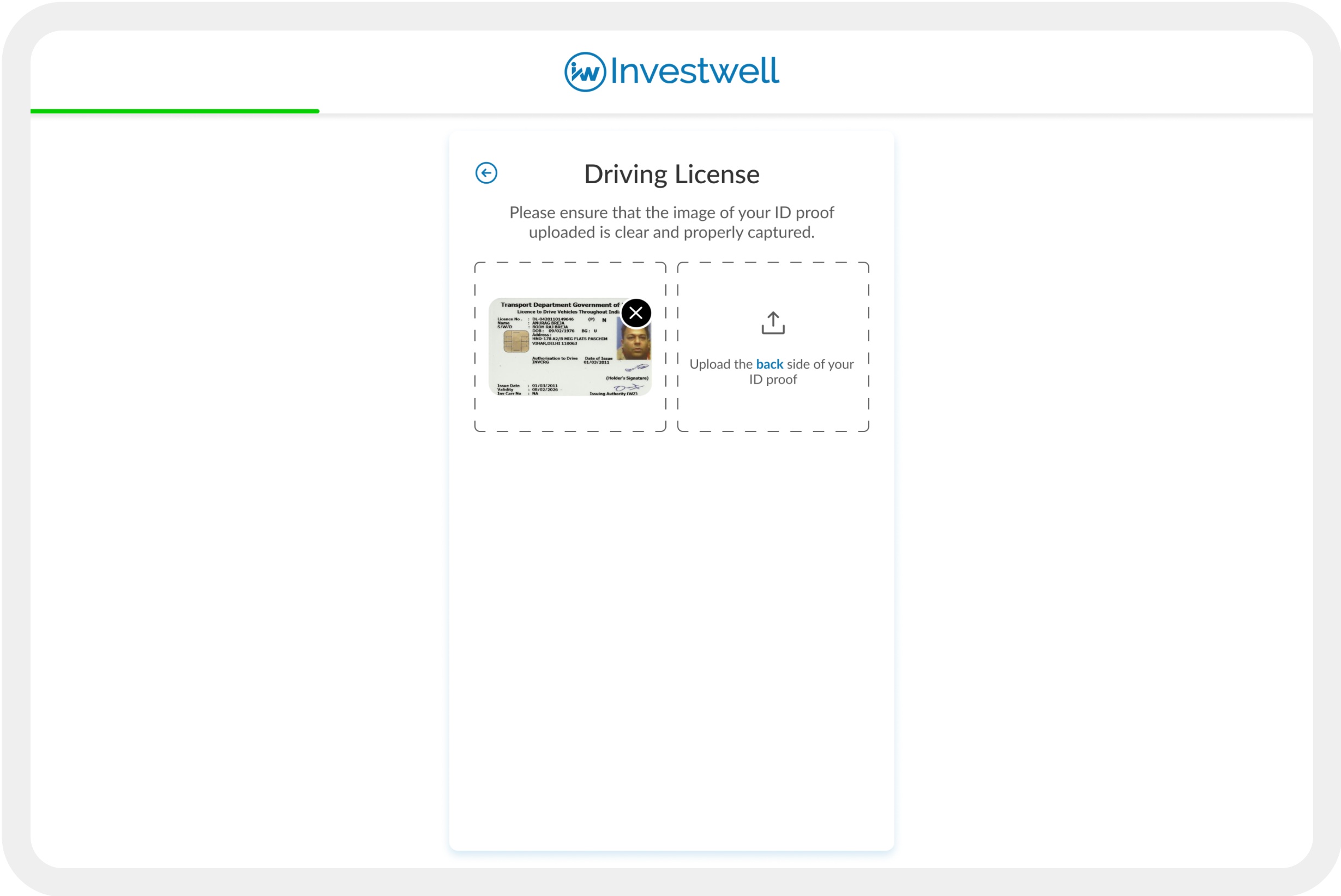

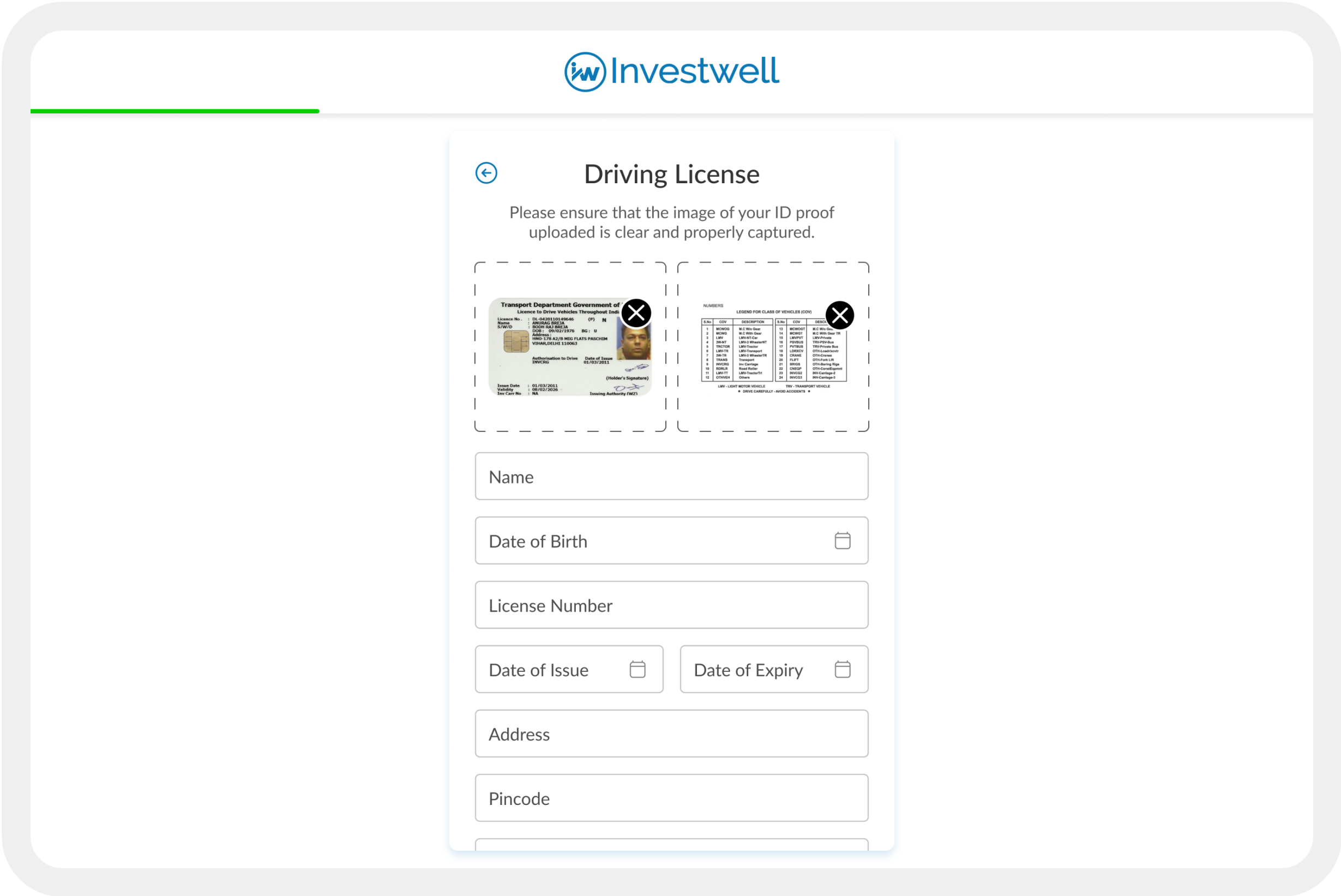

- Address Verification: Users could choose from multiple options (e.g., Aadhaar, driving license, passport).

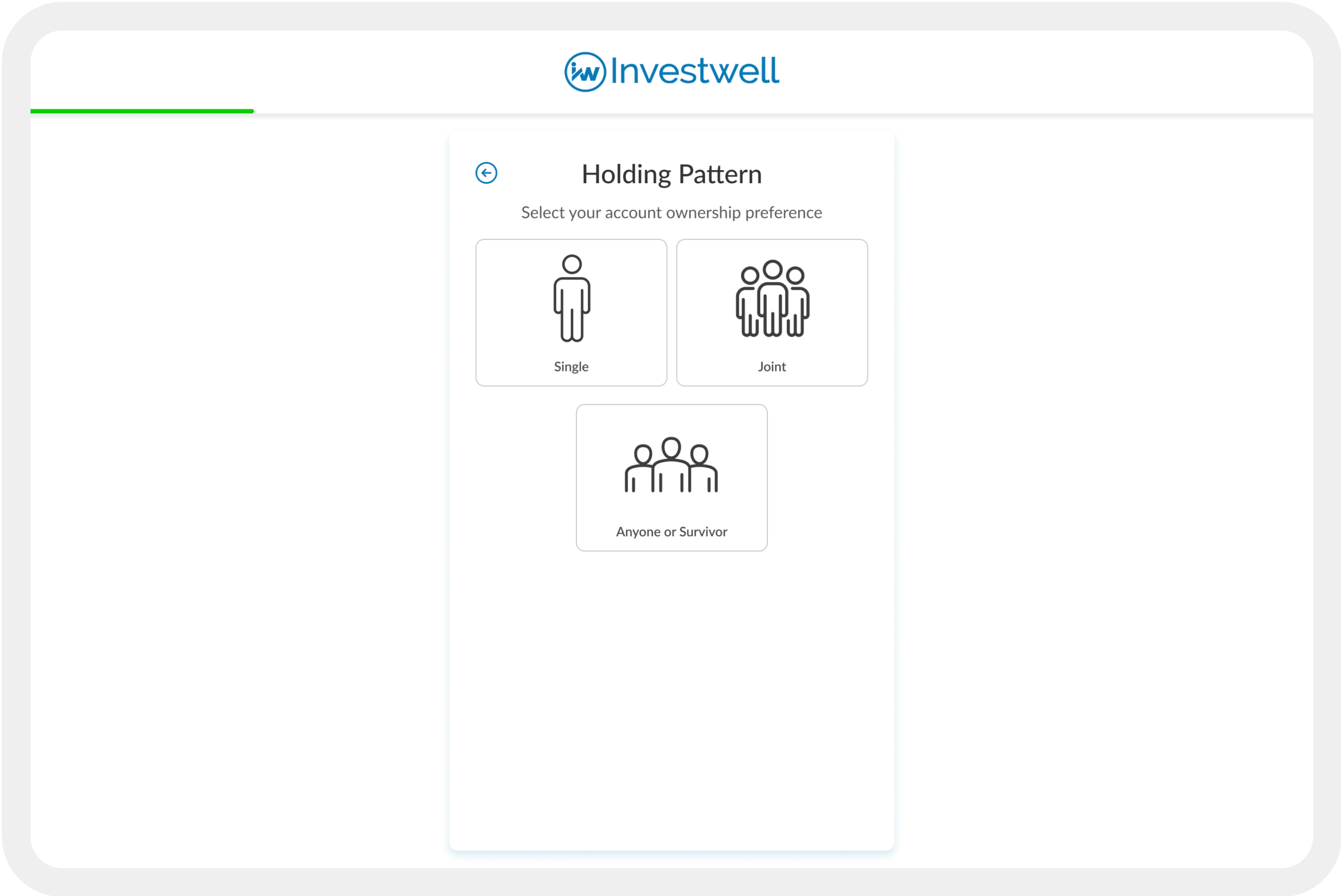

- Holding Pattern Selection: Introduced clear UI options for joint, single, or survivor patterns.

- Personal & Nominee Details: Added intuitive fields for personal data and nominee assignment.

- Bank Details: Guided users with examples on uploading a canceled cheque image.

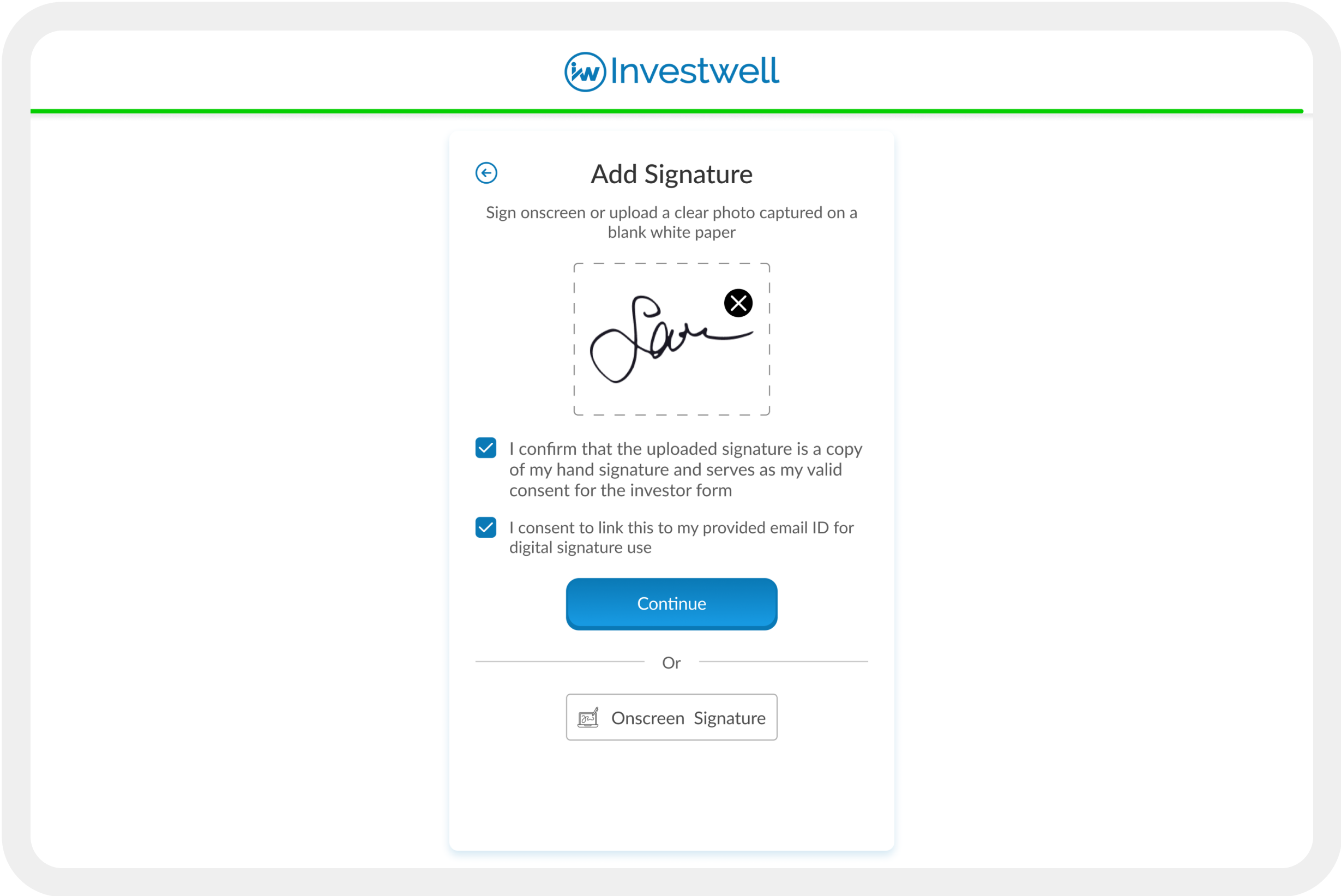

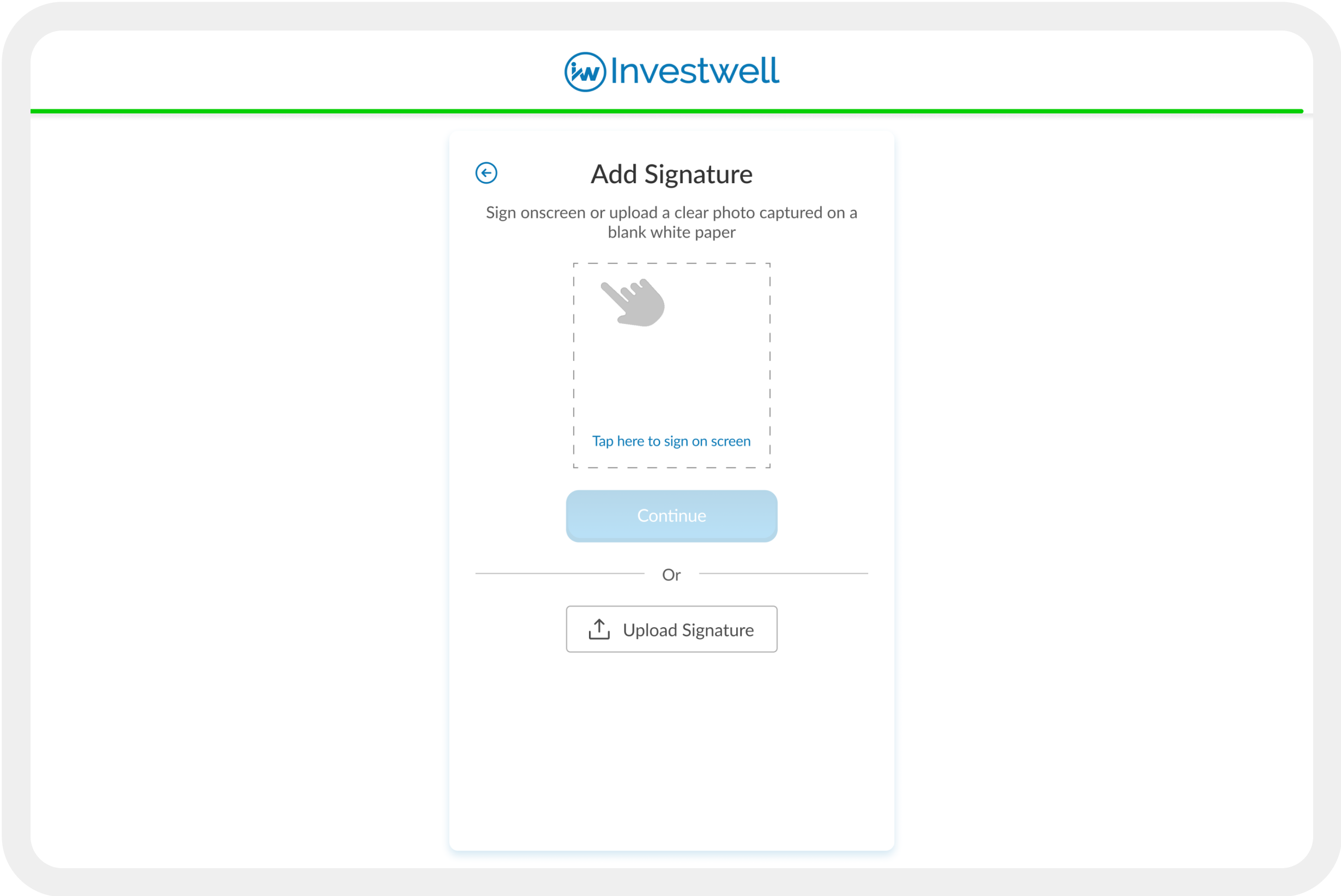

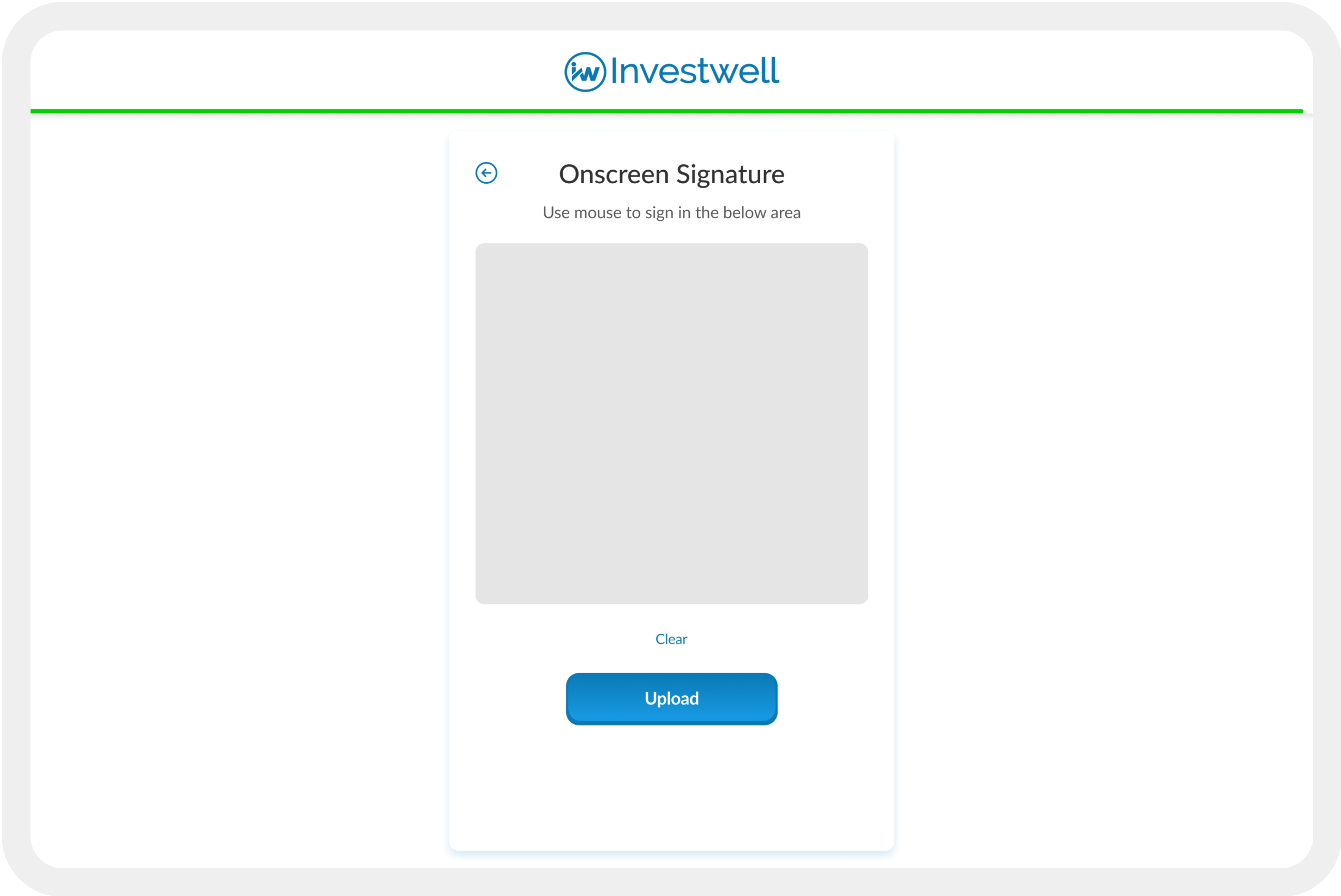

- Signature Upload: Offered both upload and on-screen signature options.

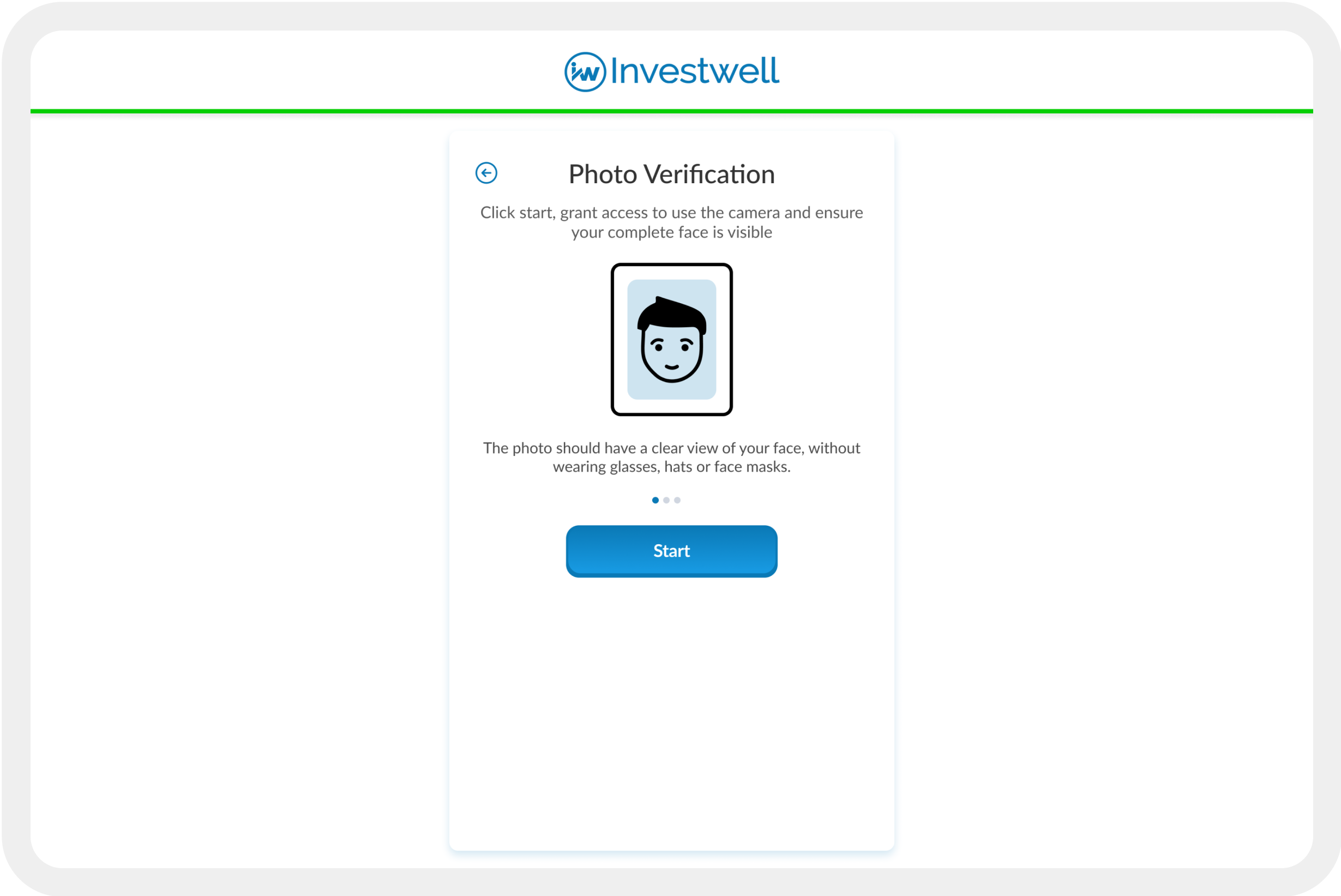

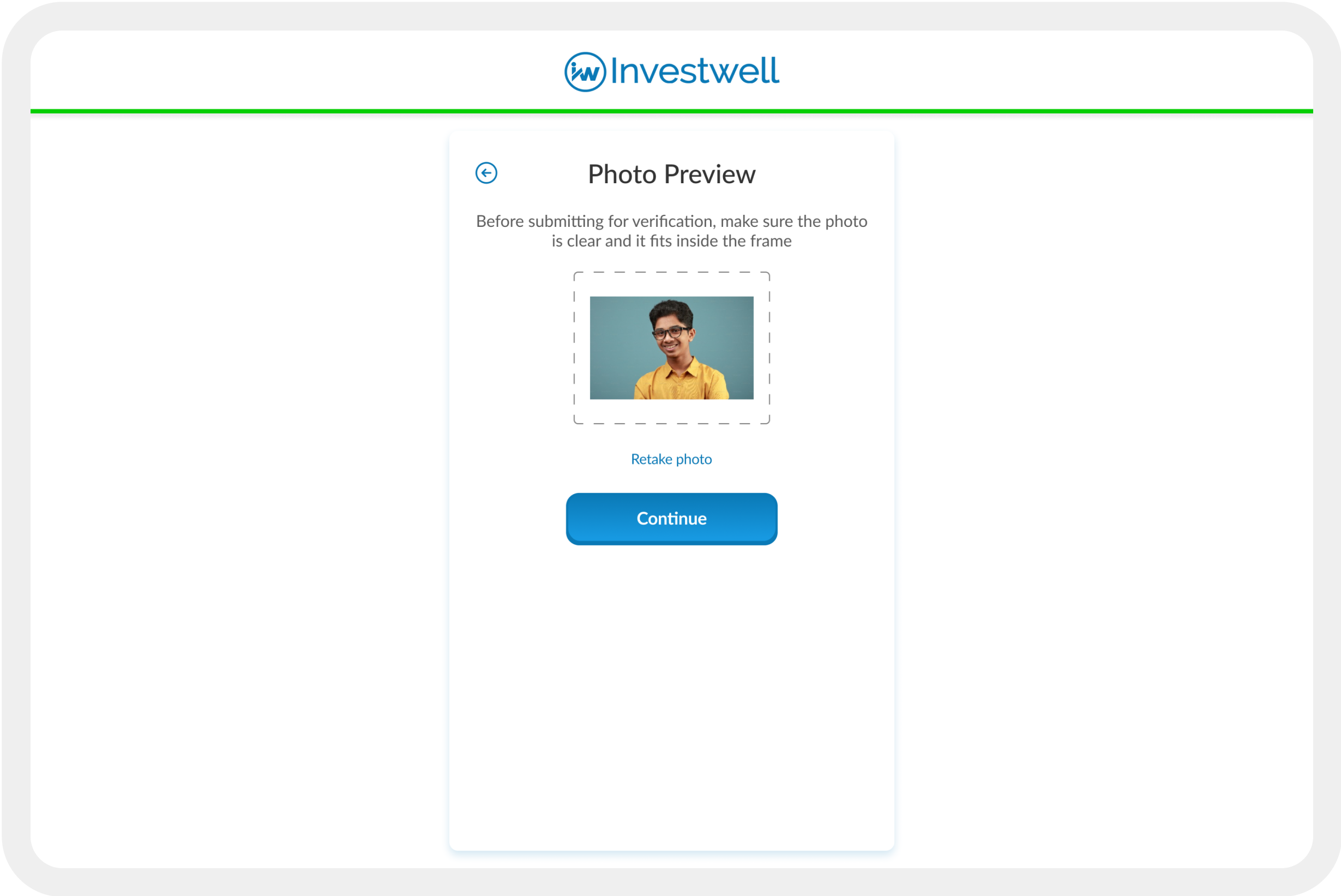

- Photo Verification: Users could retake their photo for better quality.

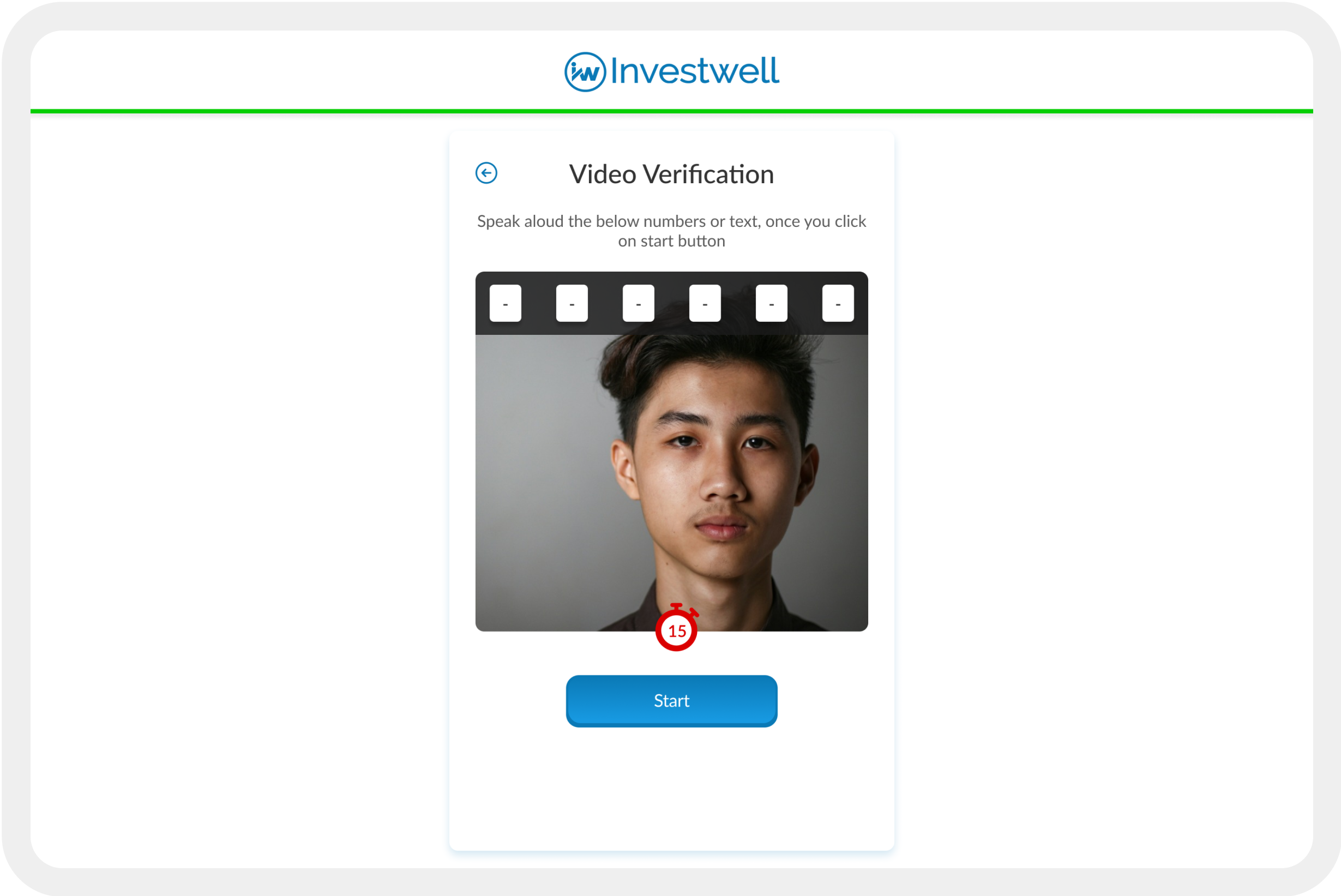

- Video Verification: Enabled recording a short video with an auto-generated number displayed on the screen.

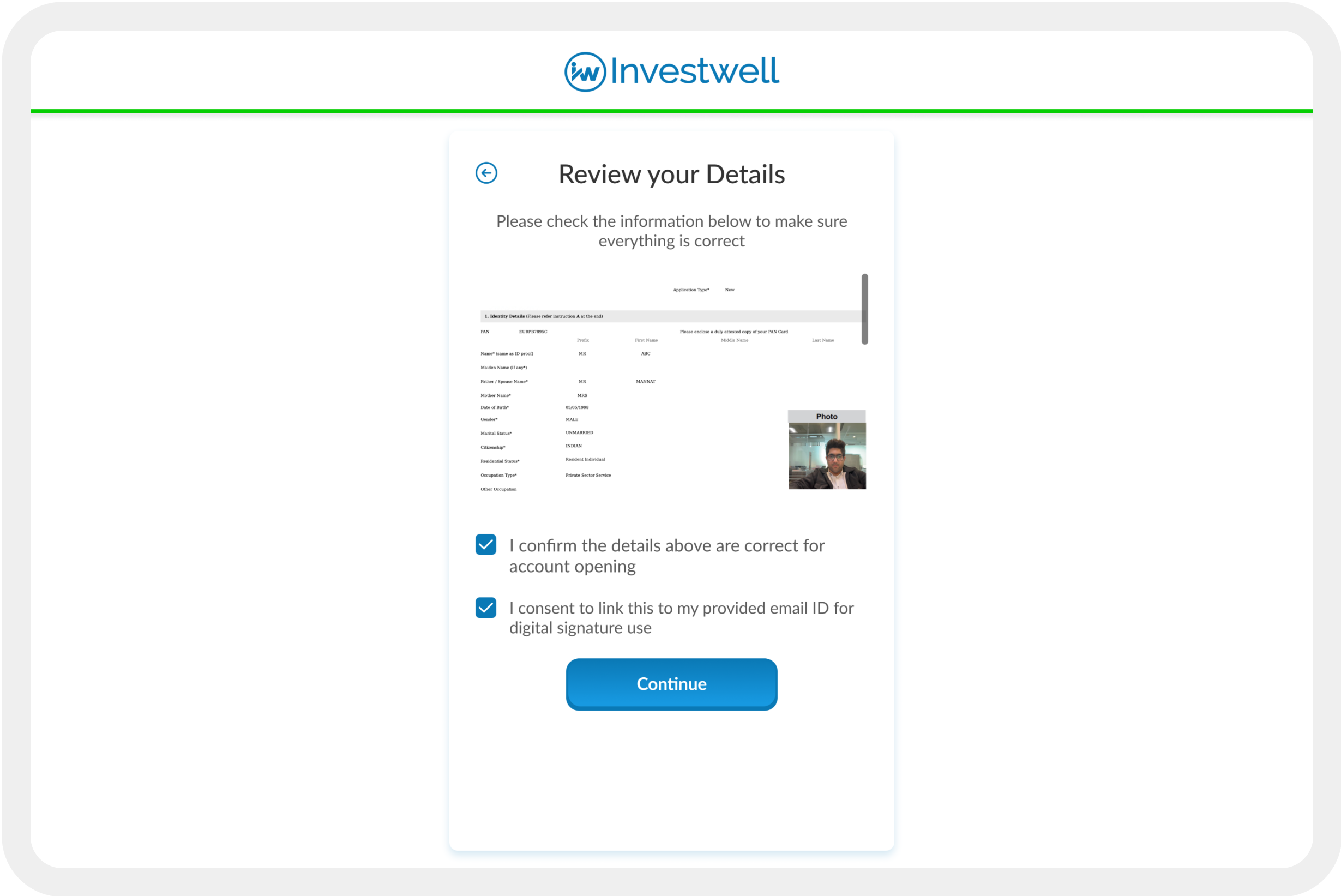

- Review Step: Gave users one final opportunity to verify all details.

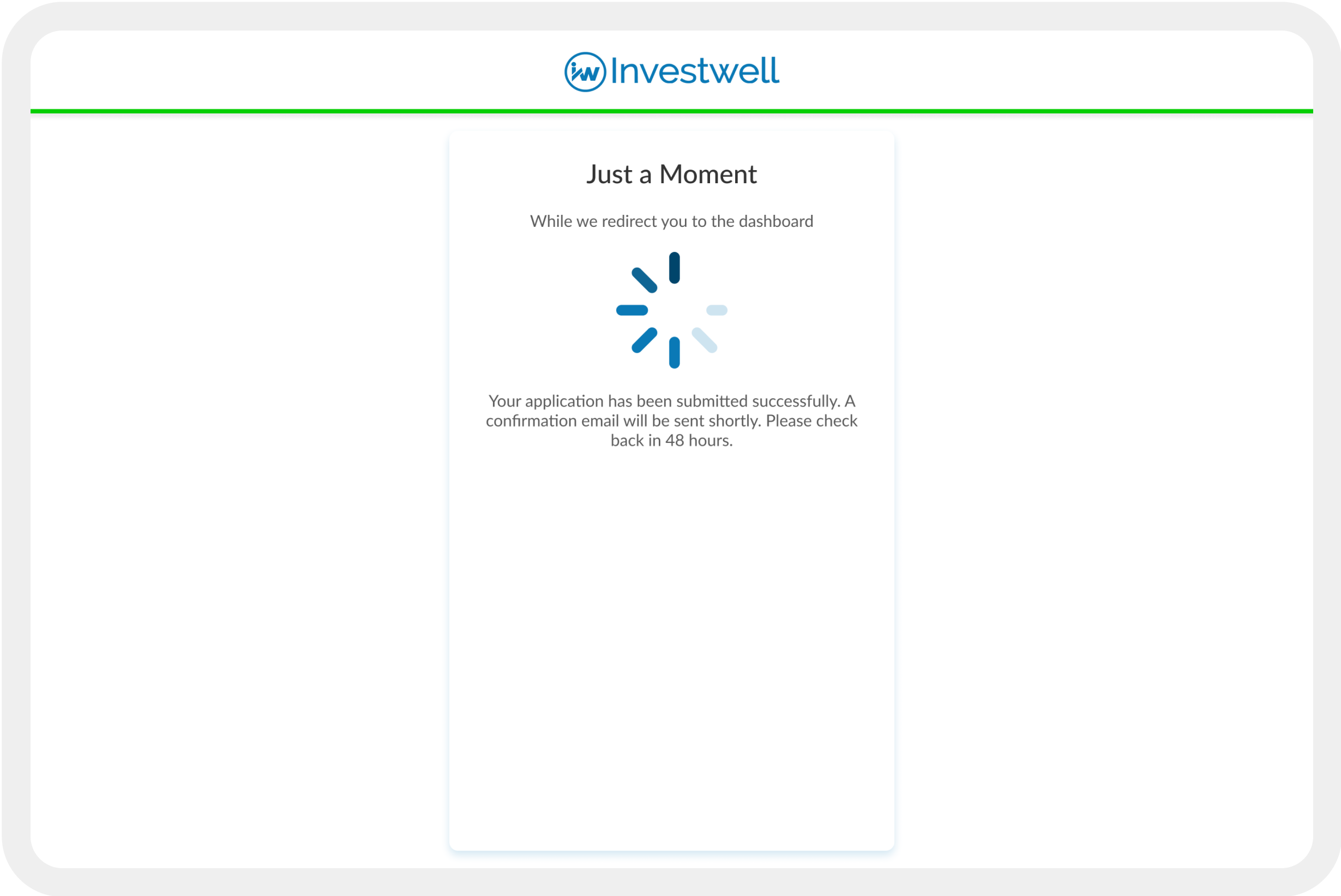

- Dashboard Redirection: After submission, users were seamlessly guided to their investment dashboard.

6. Key Innovations

- Integrated Investment Profile Creation: Automatically created investment profiles during onboarding, reducing duplicate data entry.

- Transparency for Brokers: Developed real-time tracking for brokers, allowing them to monitor application status directly from their portal.

- User-Friendly Interface: Designed with clear instructions, visual aids, and progress indicators to keep users informed and engaged.

7. The Impact

- Efficiency Boost:

- Onboarding time reduced by 50%.

- Elimination of duplicate steps resulted in smoother user journeys.

- Higher Completion Rates: KYC completion rates jumped by 30%, with fewer dropouts during the process.

- Brokers Empowered: Real-time updates reduced manual follow-ups, improving broker satisfaction.

- User Delight: Users appreciated the intuitive, guided flow and felt more confident completing their KYC on Mint’s platform.

8. Challenges & Learnings

- Challenge: Balancing the complexity of regulatory requirements with the need for simplicity in design.

- Solution: Broke down tasks into bite-sized, digestible steps and used progress indicators to reduce cognitive load.

- Challenge: Ensuring high-quality document uploads.

- Solution: Added examples and resources to improve upload quality.