1. Introduction

-

Project Context: Redesigning the investor dashboard for a fintech platform specializing in managing mutual fund portfolios.

-

Objective: Resolve usability challenges and enable investors to navigate the dashboard effectively while promoting self-service investment actions.

2. The Problem

-

Key Issues with the Existing Dashboard:

-

Investors logging in were greeted with a blank numerical display of "0" for their holdings.

-

No clear guidance on the next steps or features available.

-

Lack of engagement led to underutilization of the platform and investor frustration.

-

Limited opportunities for the company to cross-sell or upsell services.

-

3. Research Process

-

Research Goals: Understand investor behavior, identify pain points, and gather feature requirements.

-

Methods Used:

-

Stakeholder Interviews: Conducted interviews with brokers, product managers, and sales teams to align business objectives and user needs.

-

User Interviews: Spoke with a sample of existing investors to understand their experiences and expectations.

-

Competitor Analysis: Reviewed dashboards from leading fintech platforms to identify best practices in dashboard design.

-

User Journey Mapping: Charted the current journey to uncover gaps where users felt stuck or disengaged.

-

-

Key Findings:

-

Users wanted actionable next steps upon login, such as creating goals or adding investments.

-

Essential features like document uploads and risk profiling were missing from the main interface.

-

The UI lacked visual appeal, making it feel outdated and uninspiring.

-

Investors were unaware of the full capabilities of the platform, reducing its perceived value.

-

4. Design Goals

-

Provide Actionable Guidance: Offer clear next steps through widgets and personalized prompts.

-

Simplify Navigation: Make it easy for investors to access and manage key features.

-

Modernize the Visual Design: Introduce an eye-catching, clean, and intuitive layout.

-

Promote Self-Sufficiency: Equip users with tools to independently manage their portfolios.

-

Integrate Features Seamlessly: Ensure smooth onboarding, transactions, and portfolio management.

5. Design Solution

-

Core Features Introduced:

-

Action-Oriented Widgets:

-

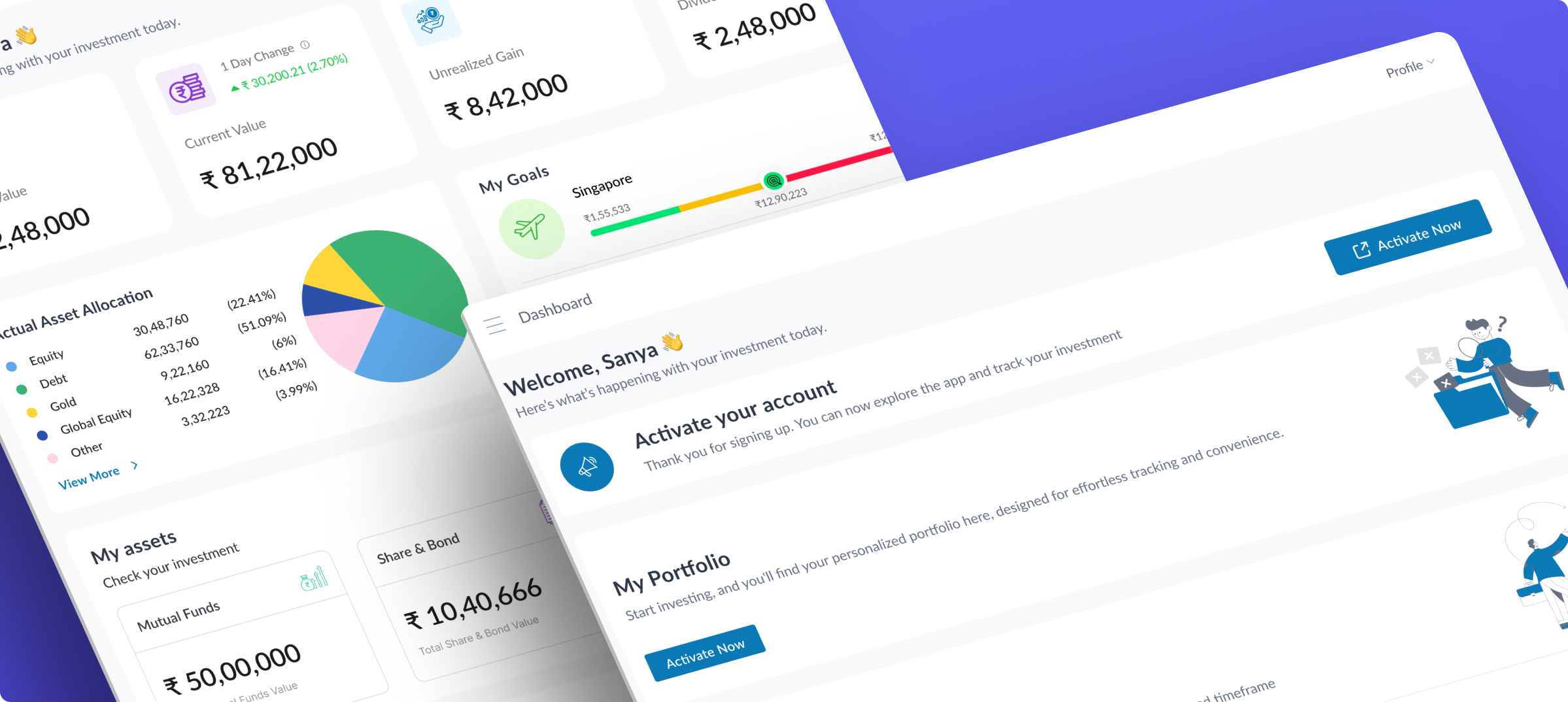

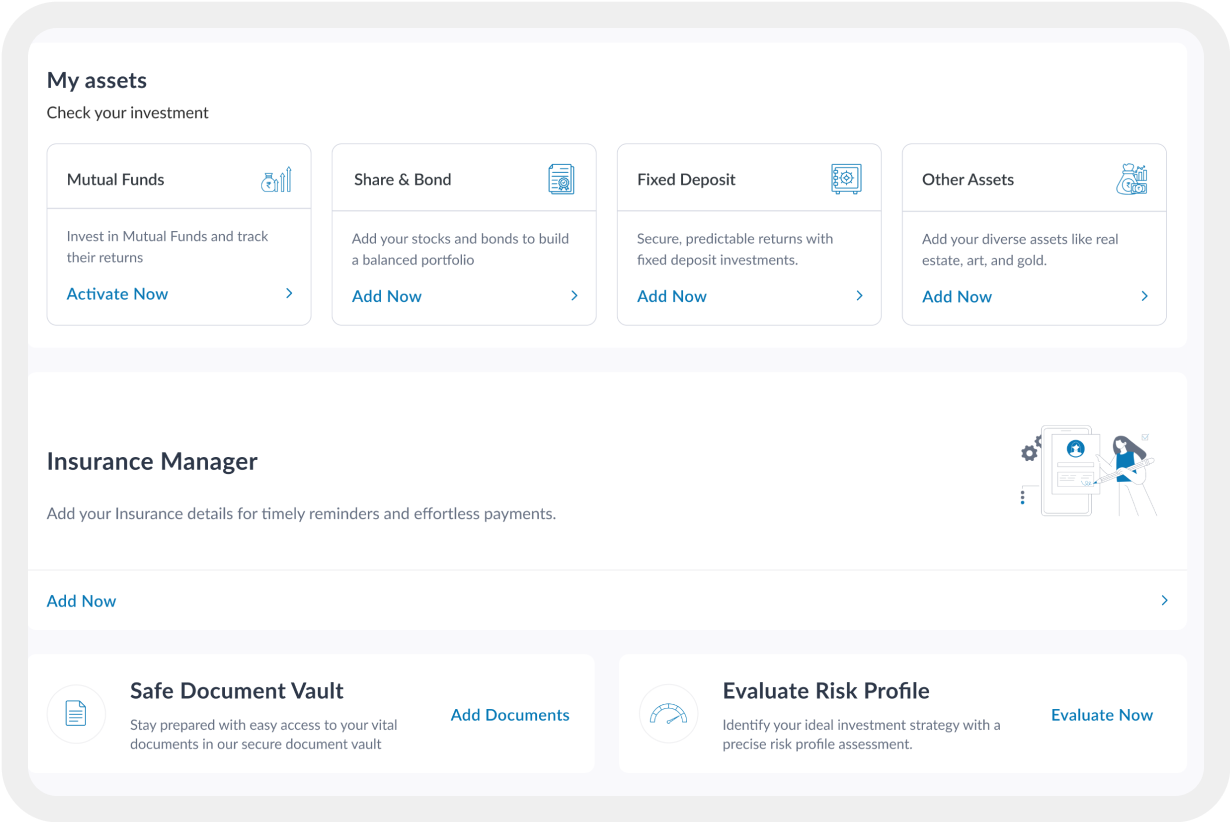

Account Activation: Simplified steps to activate accounts post-registration.

-

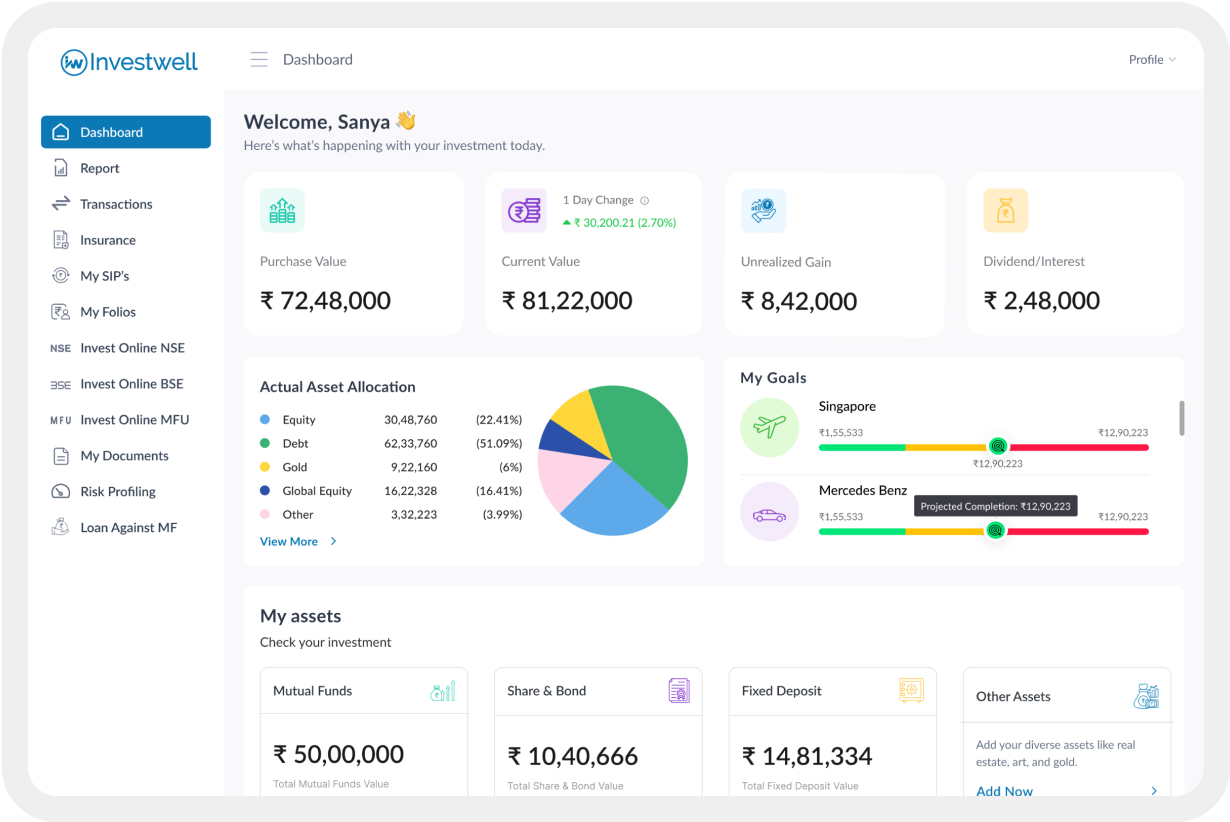

Goal Setting: Tools to define and track investment goals (e.g., saving for retirement, education).

-

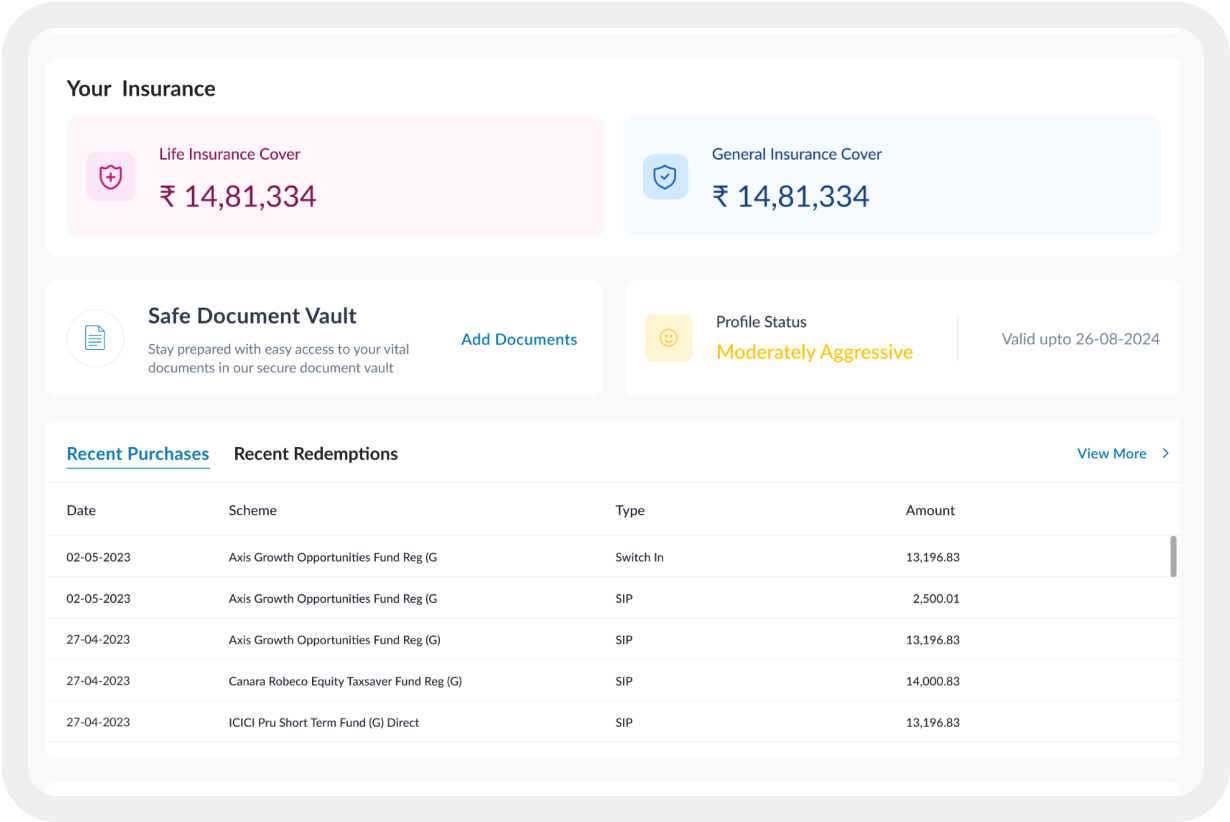

Asset Addition: Enabled users to add diverse asset classes, including mutual funds, bonds, stocks, fixed deposits, real estate, gold, and insurance policies.

-

Document Uploads: Streamlined KYC processes with Aadhaar and PAN uploads.

-

Risk Profiling: Interactive tools to assess risk appetite and suggest suitable investments.

-

Loan Options: Easy access to loans secured against mutual fund holdings.

-

-

Enhanced UI/UX:

-

Modernized interface with visually appealing charts, graphs, and typography.

-

Personalized dashboards with quick actions based on user activity.

-

Intuitive navigation ensuring effortless transitions between tasks.

-

Mobile-responsive design for seamless access across devices.

-

-

6. Execution & Collaboration

-

Design Tools Used: Miro, Figma, Maze

-

Collaboration:

-

Worked closely with developers to ensure feasibility and performance optimization.

-

Partnered with the product team to prioritize features based on user feedback and business impact.

-

-

Testing Process:

-

Conducted multiple usability testing sessions with brokers and investors.

-

Iteratively refined the design based on feedback.

-

7. Impact and Results

-

Quantitative Metrics:

-

User Engagement: 40% increase in daily active users post-launch.

-

Self-Service Actions: 60% of investors independently completed key tasks (e.g., asset addition, document uploads).

-

Adoption Rates: Significant growth in platform adoption by new investors due to the enhanced UX.

-

-

Qualitative Feedback:

-

Brokers and investors praised the intuitive interface and actionable features.

-

Increased trust in the platform due to its professional and polished design.

-

8. Reflection and Learnings

-

Challenges Faced:

-

Balancing simplicity for new investors with advanced tools for experienced users.

-

Translating complex financial data into digestible visualizations.

-

-

Key Learnings:

-

Effective user research can uncover latent needs and drive impactful design decisions.

-

Collaboration with stakeholders ensures alignment between design and business goals.

-

Iterative testing is critical to creating a product that resonates with users.

-

-

Future Opportunities:

-

Incorporate AI-driven insights for personalized investment recommendations.

-

Explore gamification elements to further engage investors (e.g., milestone badges).

-