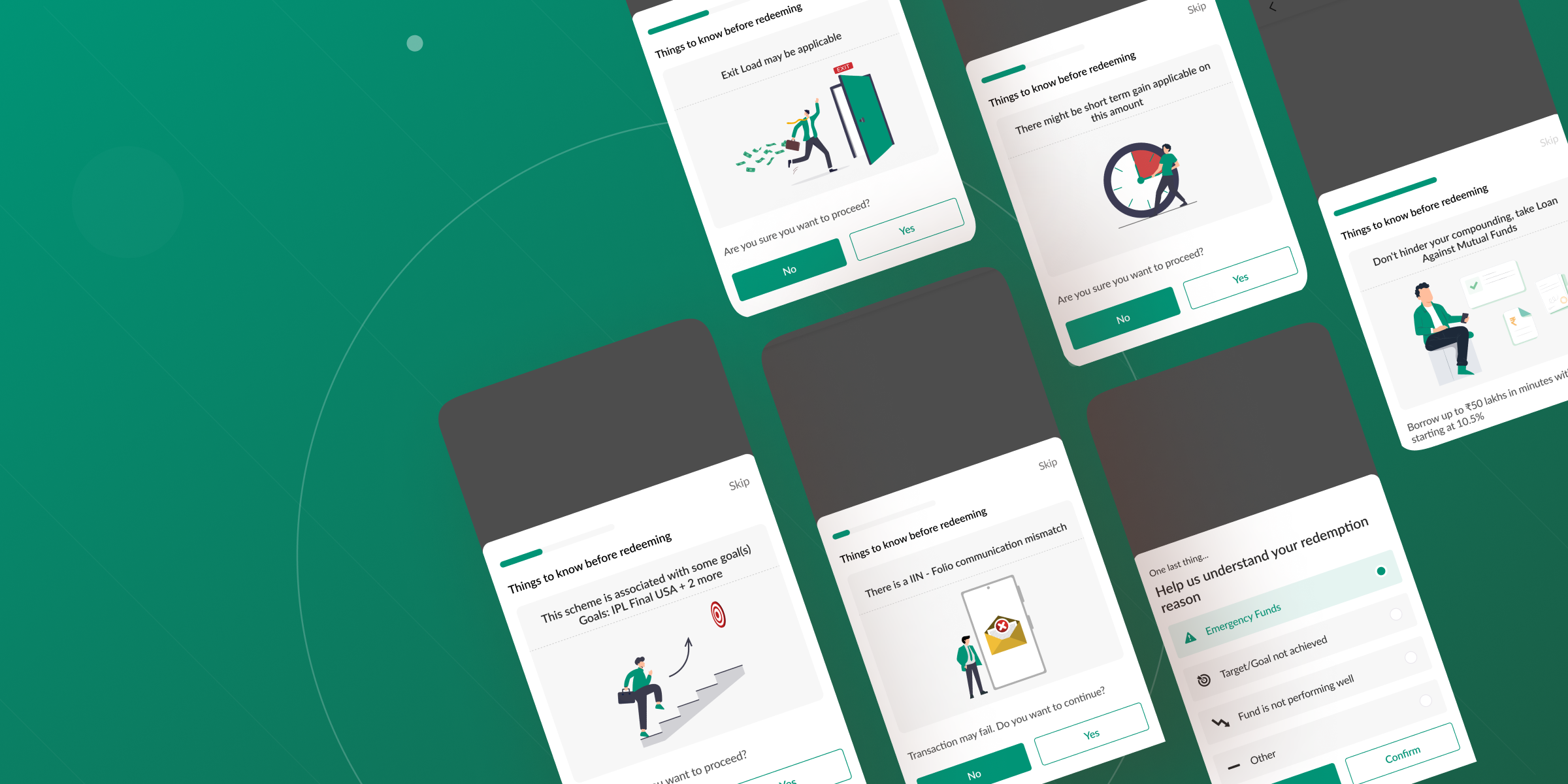

transaction-nudges-inner-cover.png

Transaction Nudges – Enabling Informed Decisions

1. Project Overview

The Transaction Nudges feature was conceptualized to provide contextual, actionable information during transactions on Mint's app. These nudges aimed to:

- Educate Users: Alert users to critical details like tax implications or missing compliance requirements.

- Guide Behavior: Encourage users to take informed actions (e.g., linking Aadhaar, adding nominees).

- Seamlessly Integrate: Ensure the transaction process remained fluid and non-disruptive.

This project required balancing the need for relevant user guidance with the demand for speed and simplicity in financial transactions.

2. Problem Statement

Through research, we identified key pain points for users:

- Lack of Awareness: Users were often unaware of critical financial or regulatory details (e.g., nominee missing, exit loads).

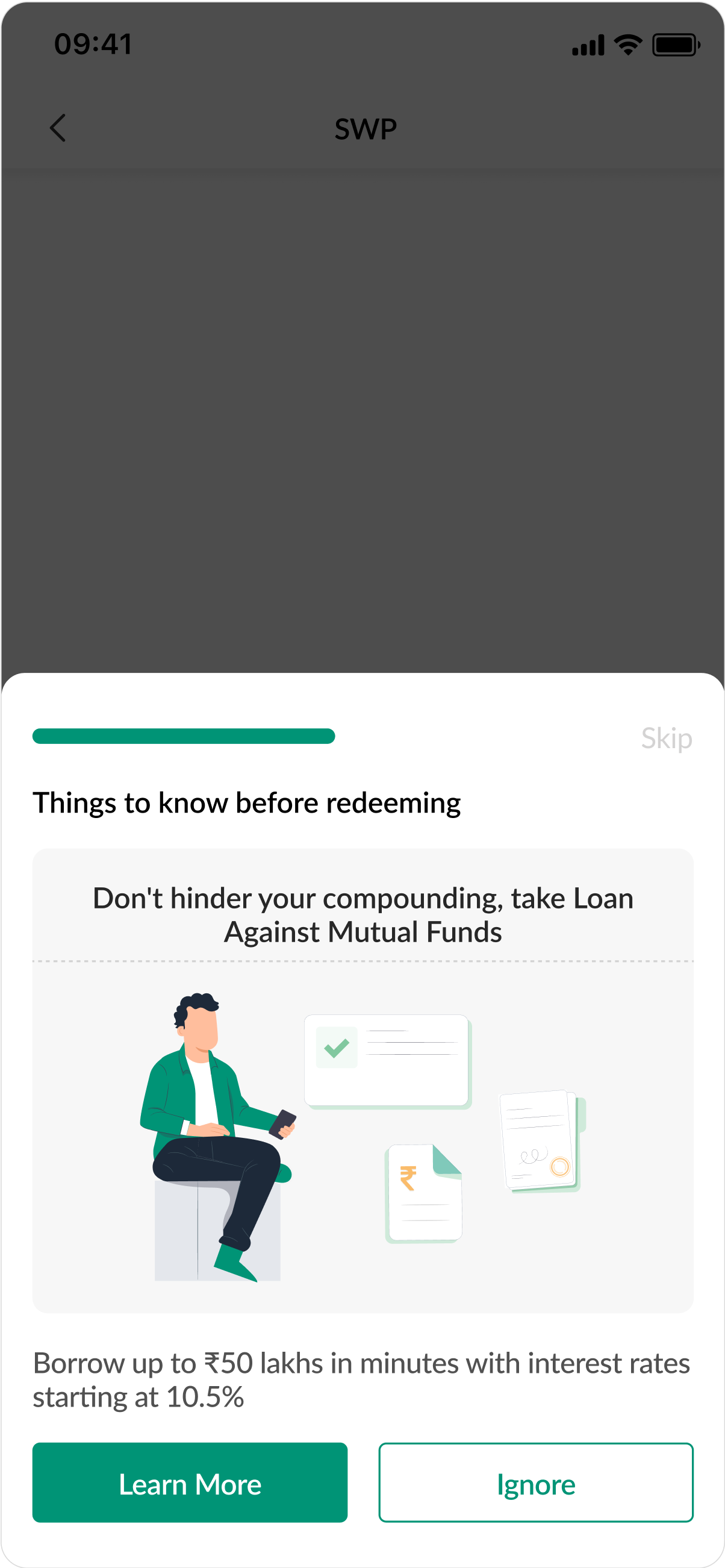

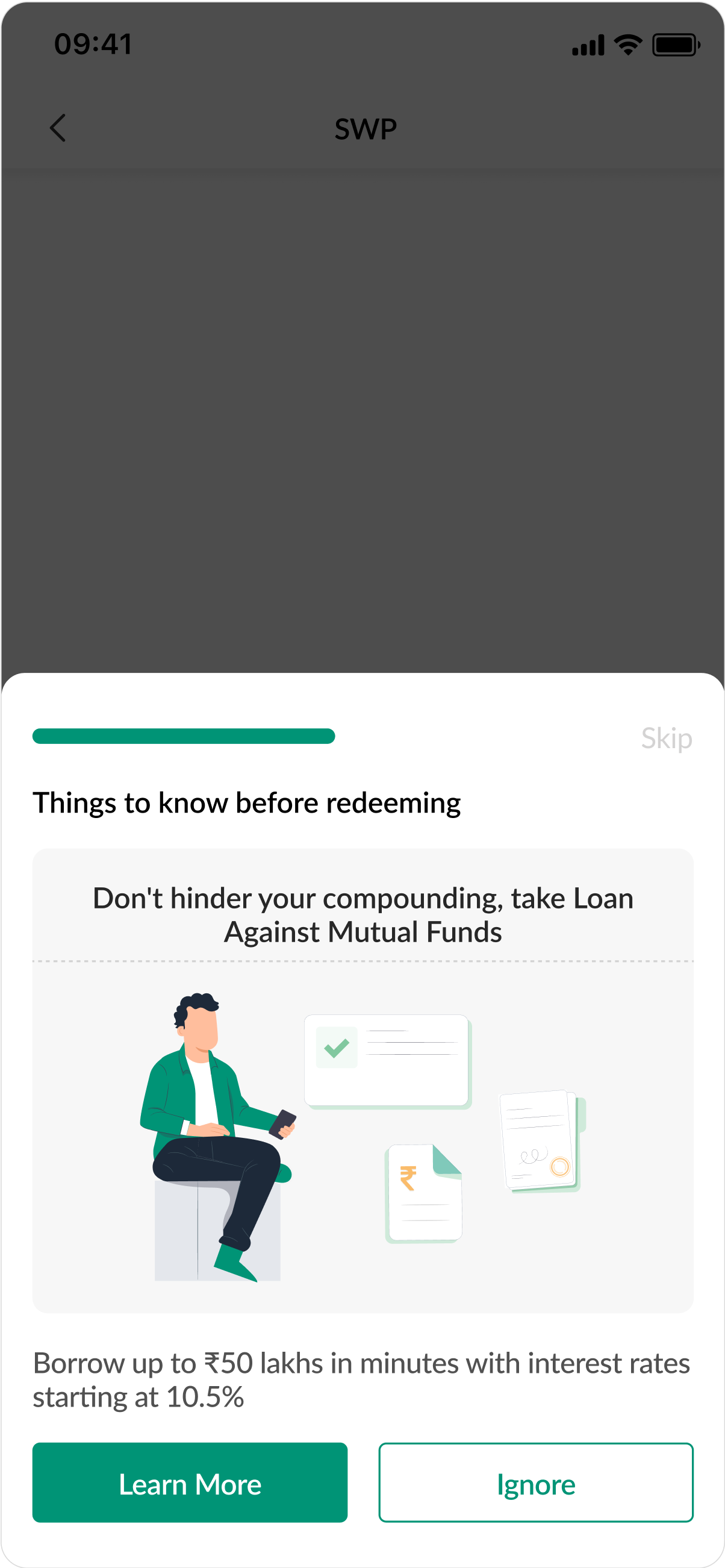

- Missed Opportunities: Features like the Goal Planner or Loan Against MF were underutilized due to limited visibility.

- Disruption Concerns: Providing guidance risked interrupting the transaction flow, leading to user frustration.

Challenge: How can we deliver timely, relevant guidance during transactions while maintaining a seamless user experience?

3. Research Process

A. User Research

- Surveys and Feedback: Collected feedback from users who regularly transact via the app. Identified frequent pain points, such as missing nominee information or confusion around tax implications.

- User Personas:

- Active Investors: High transaction frequency, prioritize efficiency.

- Compliance-Focused Users: Concerned about legal and regulatory adherence.

- Goal-Oriented Users: Focused on long-term financial goals.

B. Behavioral Analysis

- Reviewed transaction logs to identify patterns of incomplete actions (e.g., skipped Aadhaar linking, unresolved risk profile mismatches).

- Analyzed feature adoption metrics for Goal Planner and Loan Against MF.

C. Competitive Benchmarking

- Evaluated similar features in fintech apps to identify best practices and gaps.

Key Insights:

- Users are open to guidance but dislike forced interruptions.

- Clear, actionable, and skippable nudges are necessary for maintaining trust.

- Providing contextual relevance is critical—nudges must align with transaction types and user conditions.

4. Design Goals

- Contextual Relevance: Nudges should appear only when predefined conditions are met.

- Non-Disruptive Flow: Allow users to skip nudges if they choose, ensuring the transaction process remains smooth.

- Actionable Insights: Each nudge must provide clear information and two CTAs (e.g., Learn More, Skip).

- Dynamic Control: Enable backend-driven updates for flexibility in logic, content, and ordering.

5. The Solution

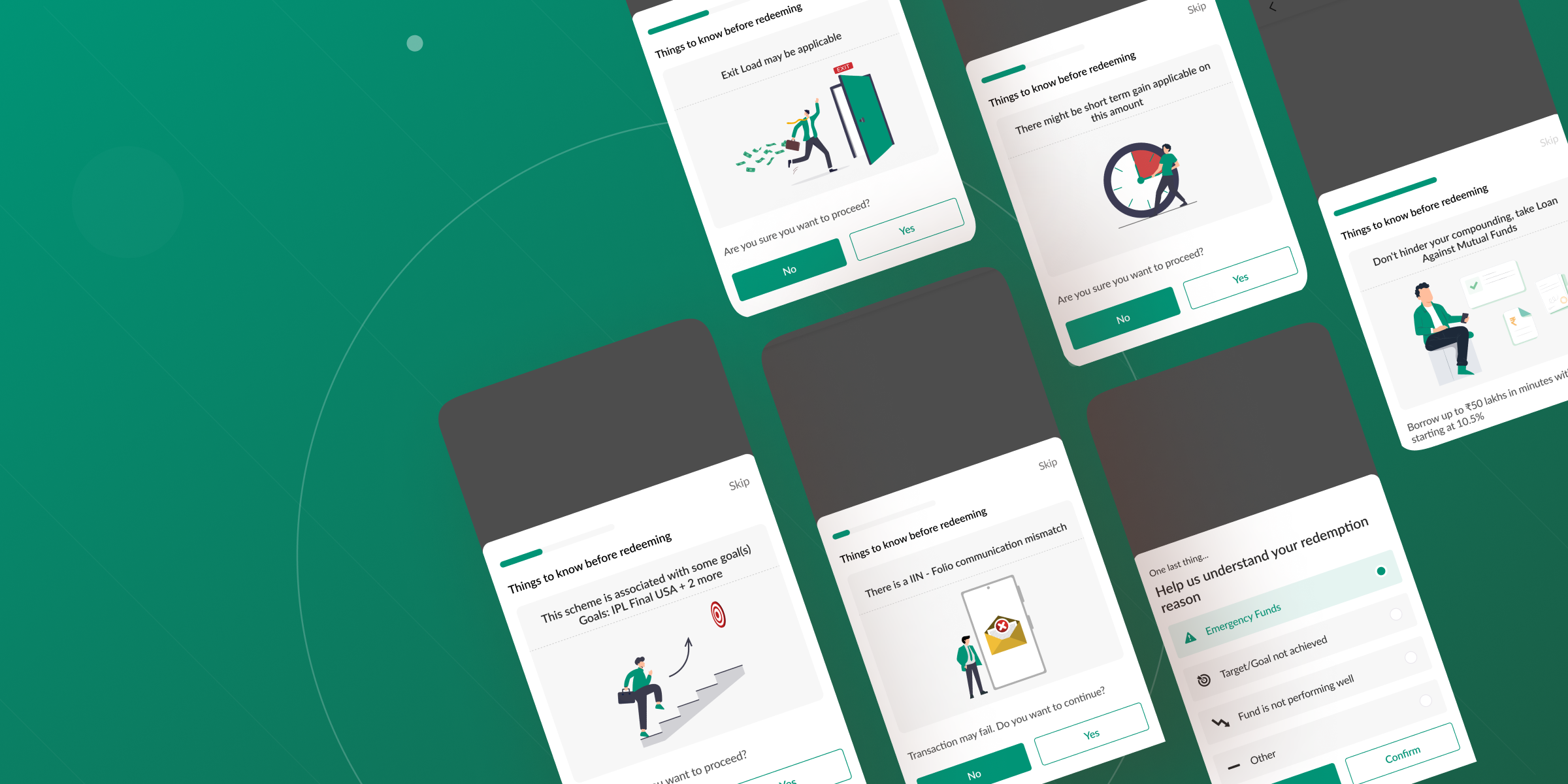

A. Nudge Framework

- Trigger Points: Nudges are triggered when users click Place Order or Transact Now.

- Popup Design:

- Mint-themed design with concise text, SVG visuals, and two CTAs.

- Progress Bar: Guides users when multiple nudges are applicable.

- Skip Option: Users can bypass nudges without completing all steps.

B. Nudge Categories

- PAN-Aadhaar Link Missing

- Trigger: Purchase/SIP for folios flagged as Aadhaar unlinked.

- Purpose: Ensure regulatory compliance.

- CTA: Link Aadhaar | Skip

- Nominee Missing

- Trigger: Purchase/SIP for folios without a nominee.

- Purpose: Promote financial security.

- CTA: Add Nominee | Skip

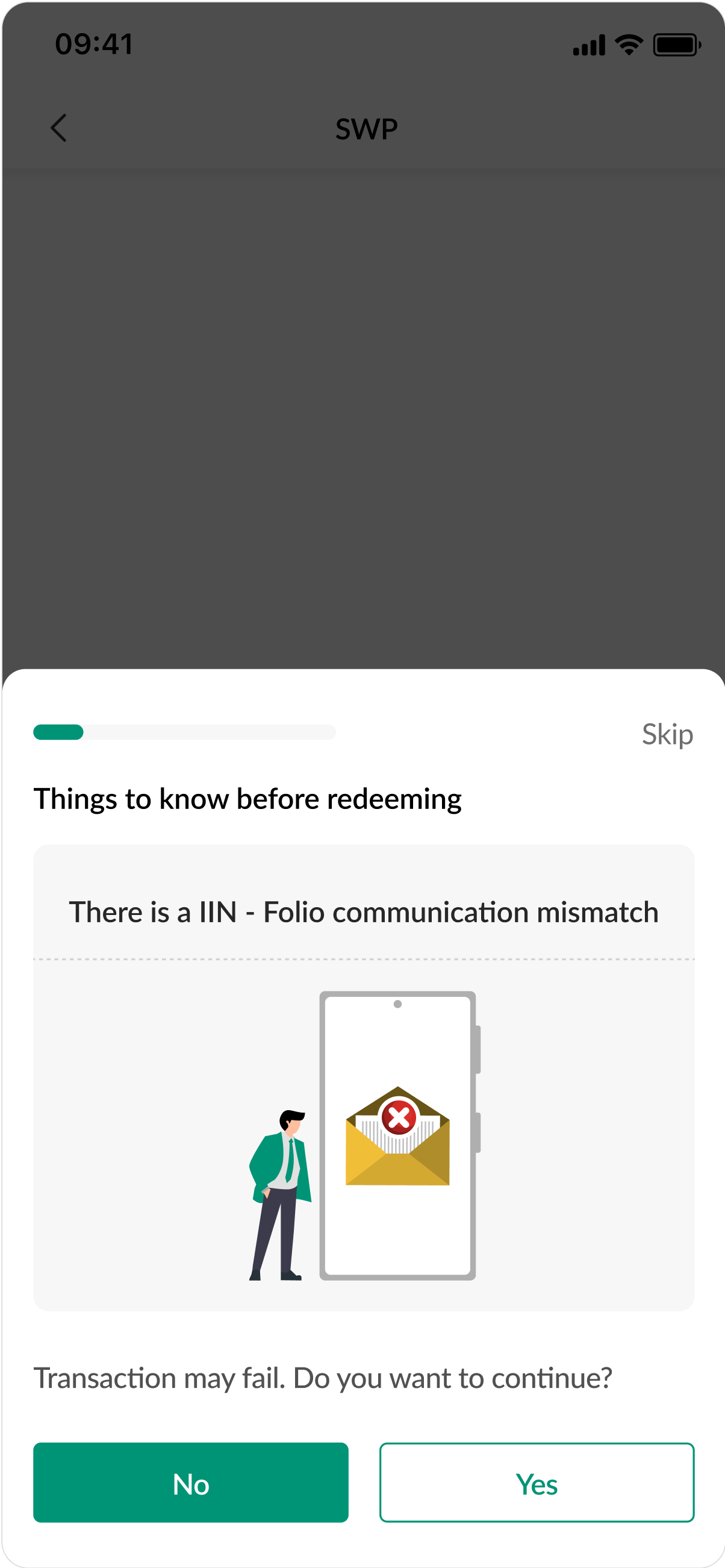

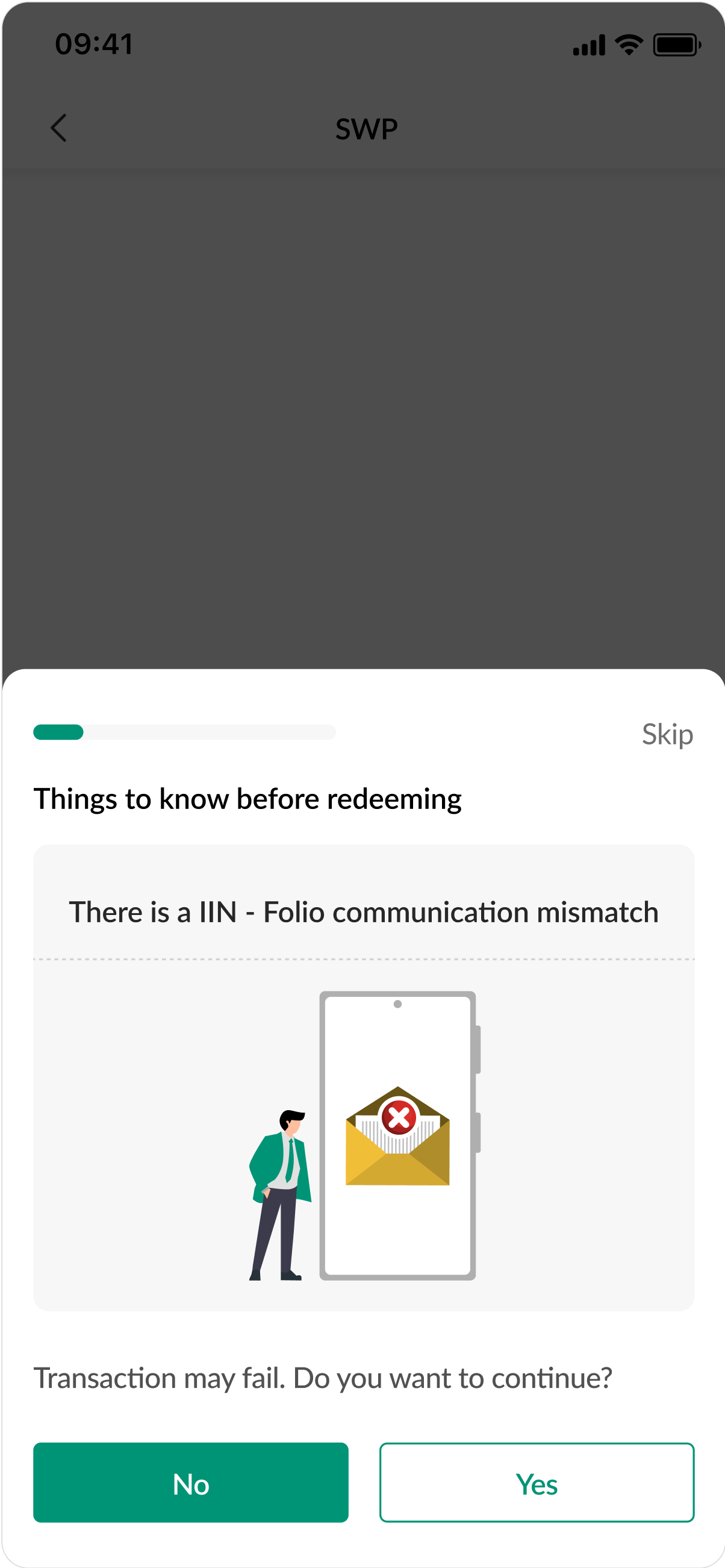

- IIN/UCC Communication Mismatch

- Trigger: All transaction types for flagged folios.

- Purpose: Resolve communication discrepancies.

- CTA: Verify Details | Skip

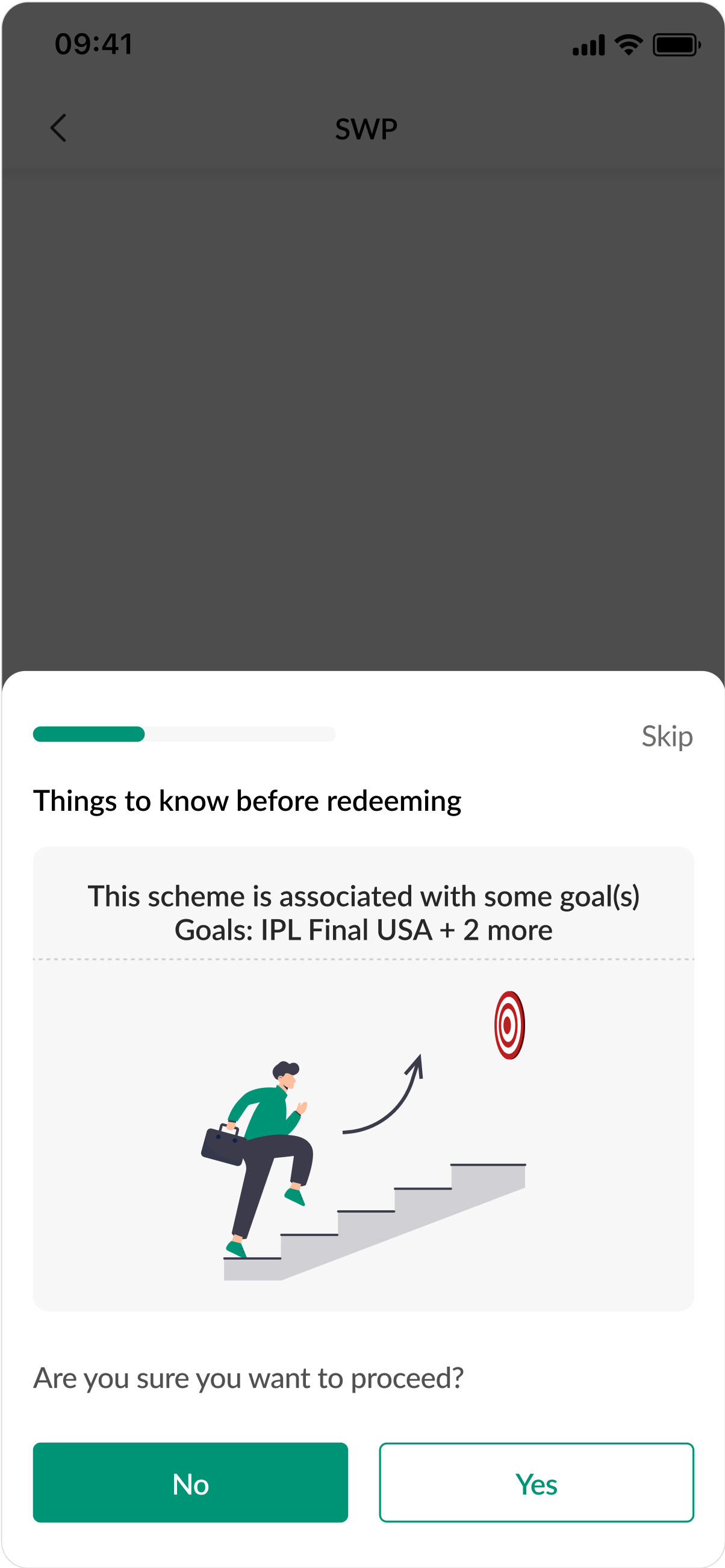

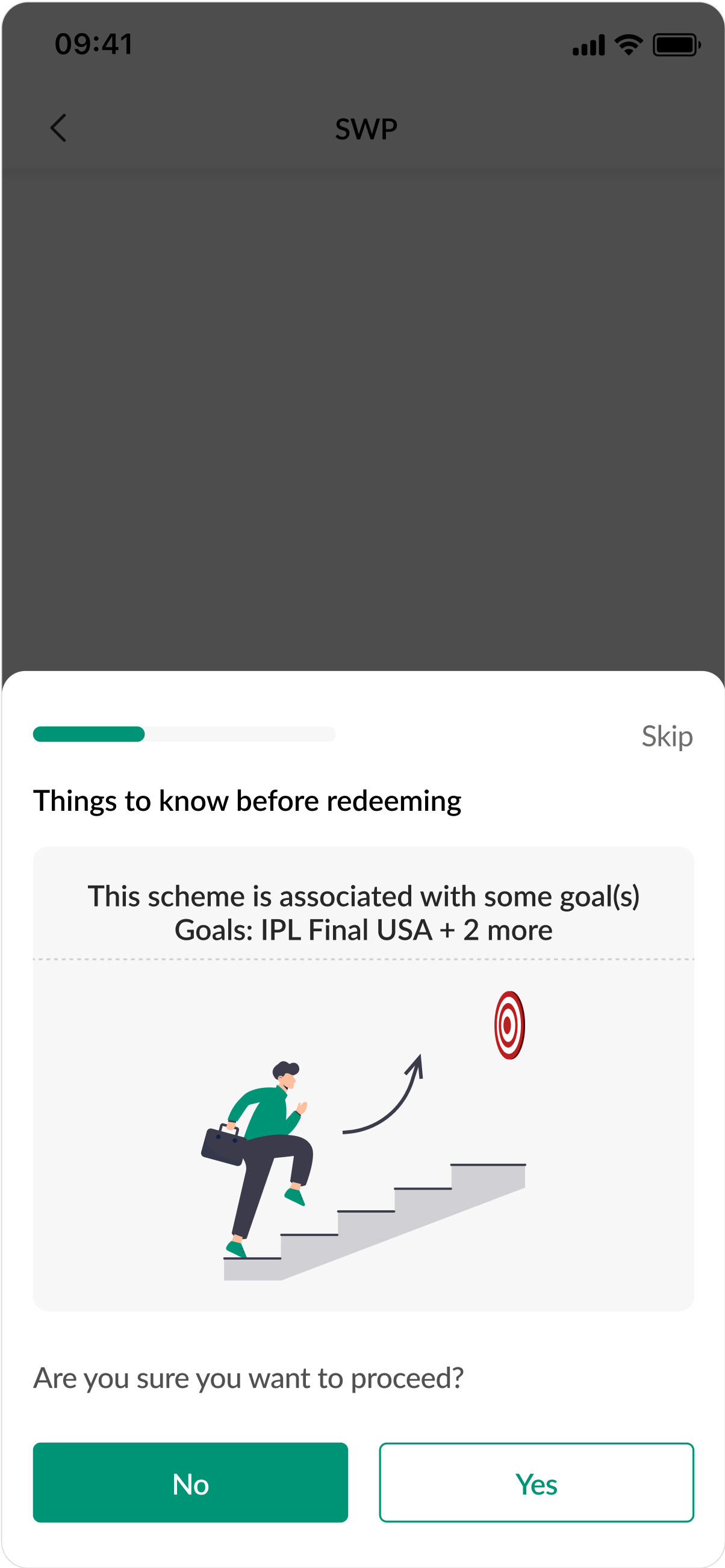

- Goal Planner

- Trigger: Redemption for schemes linked to goals with unmet target dates.

- Purpose: Prevent premature redemption.

- CTA: View Goal | Skip

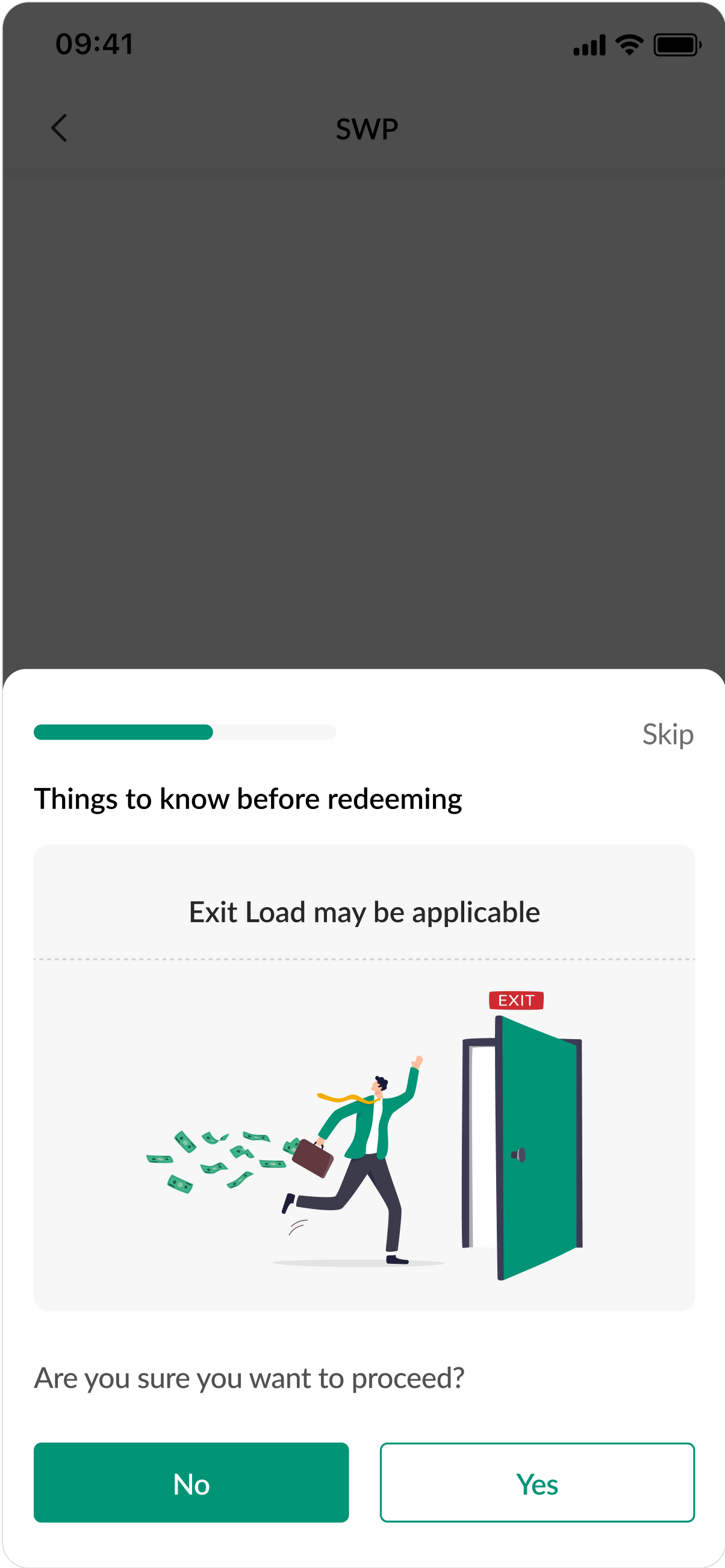

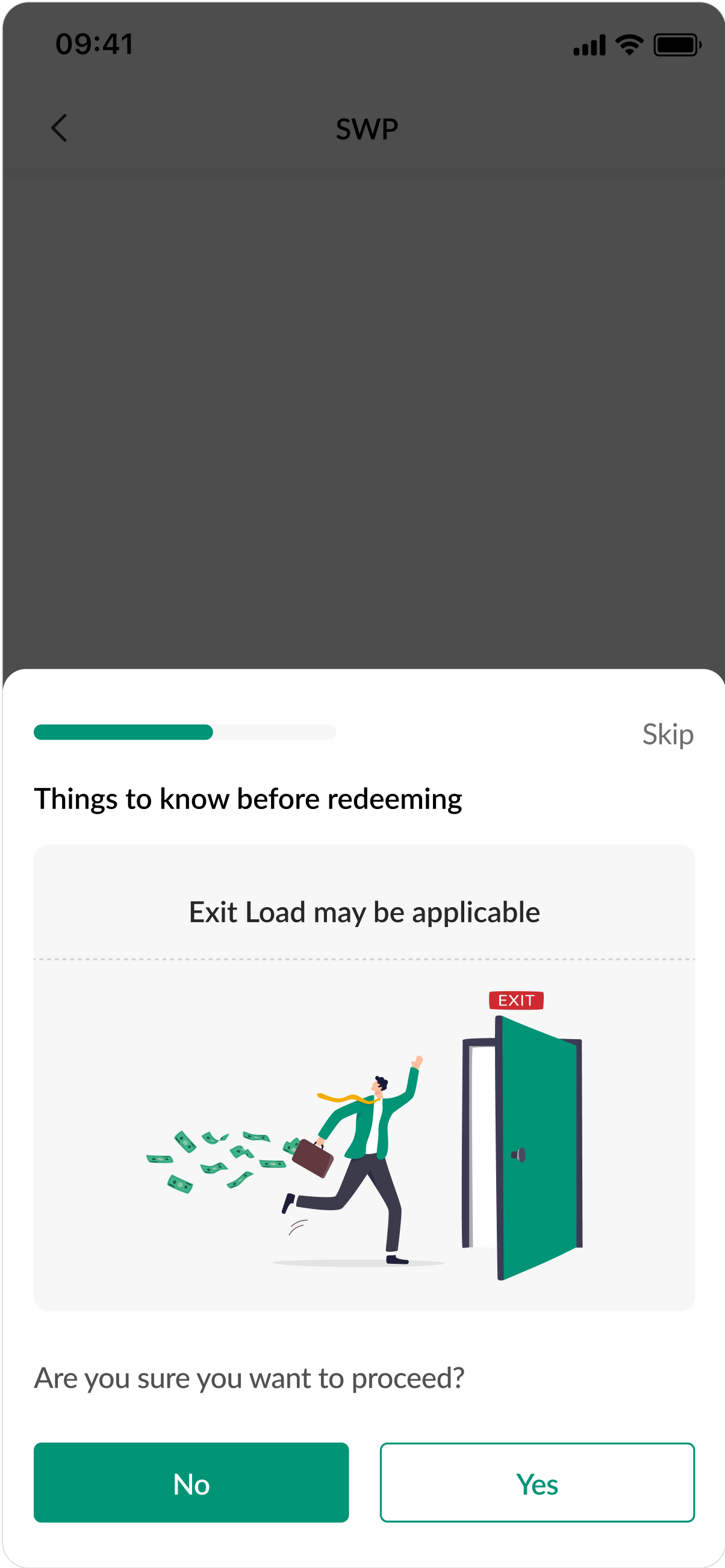

- Exit Load

- Trigger: Redemption transactions.

- Purpose: Warn users of potential charges.

- CTA: View Details | Skip

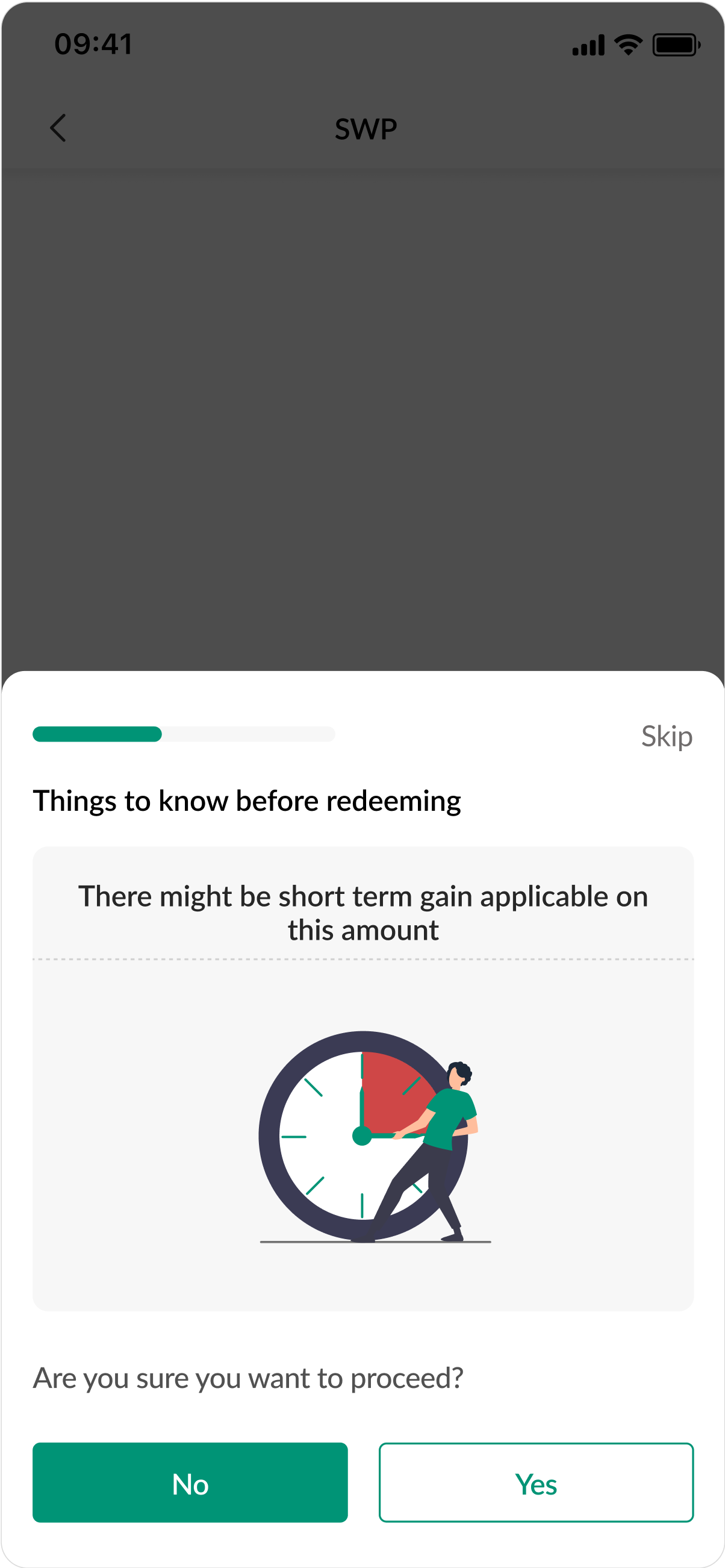

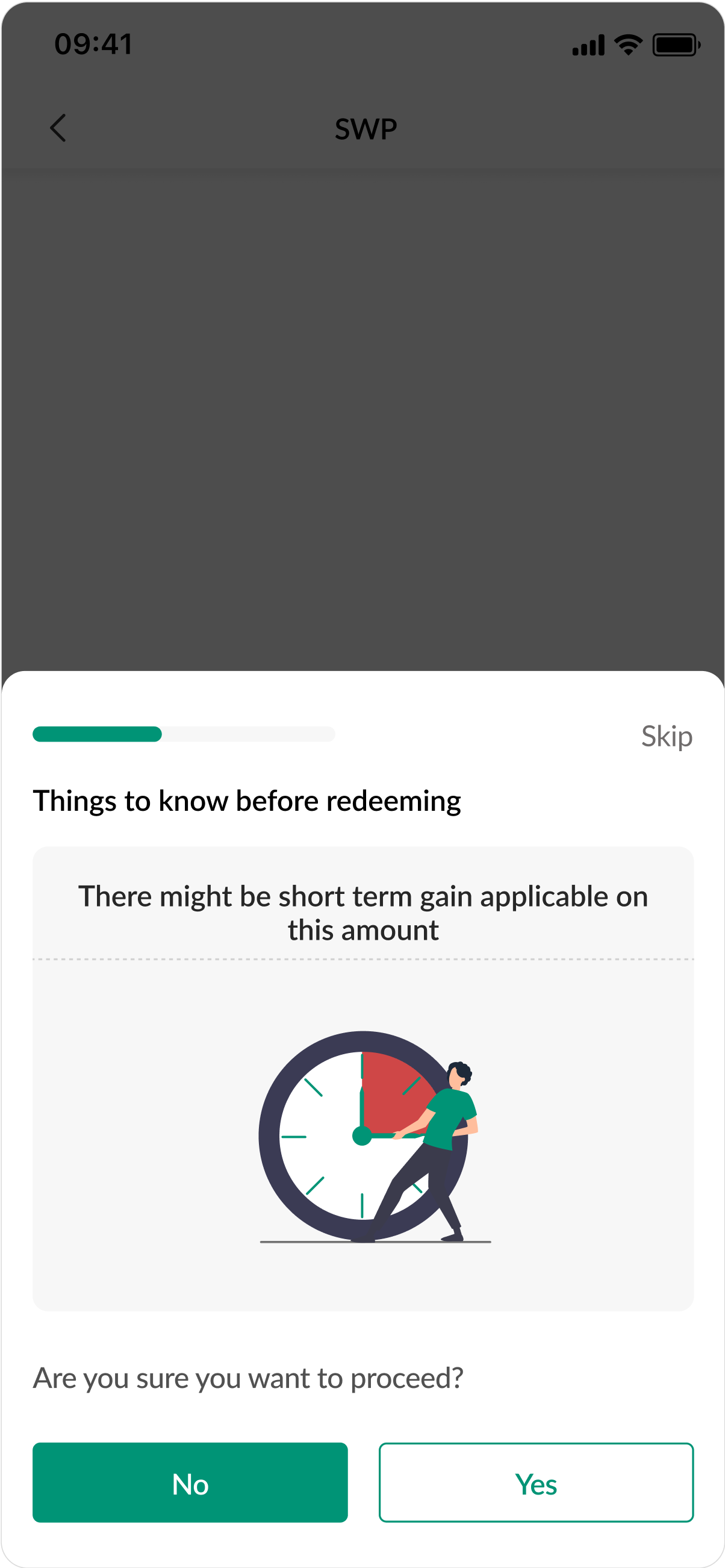

- Short-Term Gain

- Trigger: Redemption for transactions incurring short-term gains.

- Purpose: Highlight tax implications.

- CTA: Learn More | Skip

- Risk Profile Mismatch

- Trigger: Purchase/SIP for schemes exceeding client risk profiles.

- Purpose: Align investments with risk tolerance.

- CTA: Update Profile | Proceed Anyway

C. Backend Flexibility

- Dynamic Controls:

- Backend-managed logic for adding, removing, or modifying nudges.

- Flexibility in reordering nudges based on business priorities.

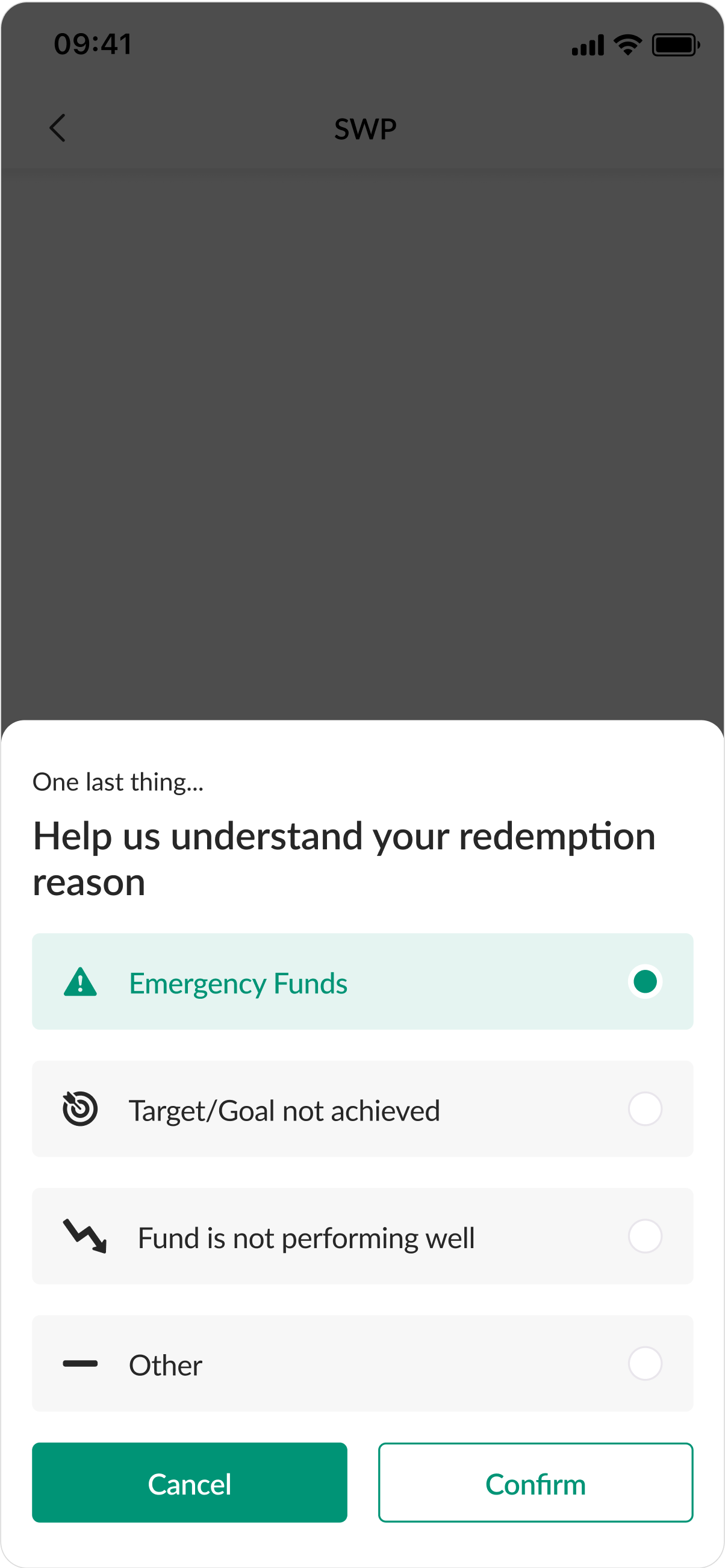

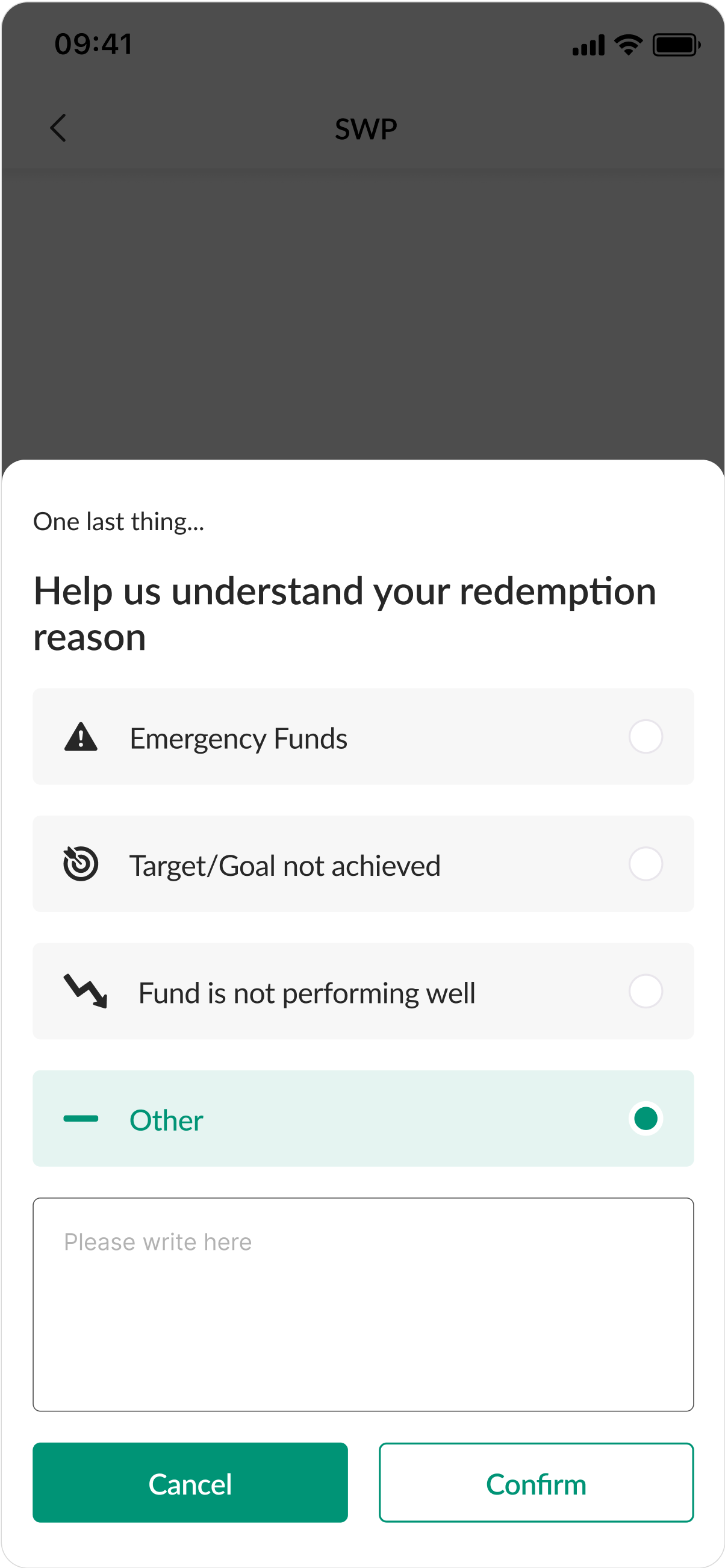

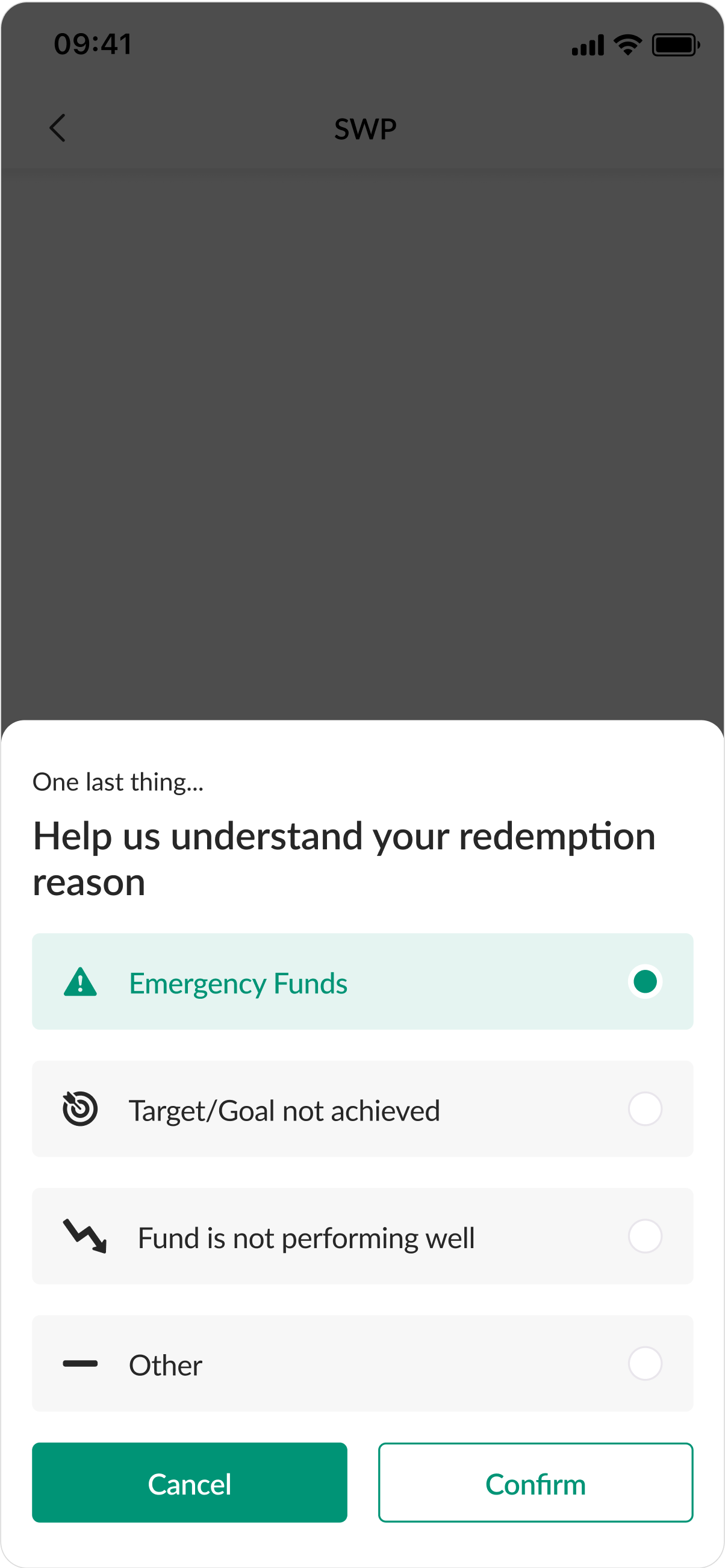

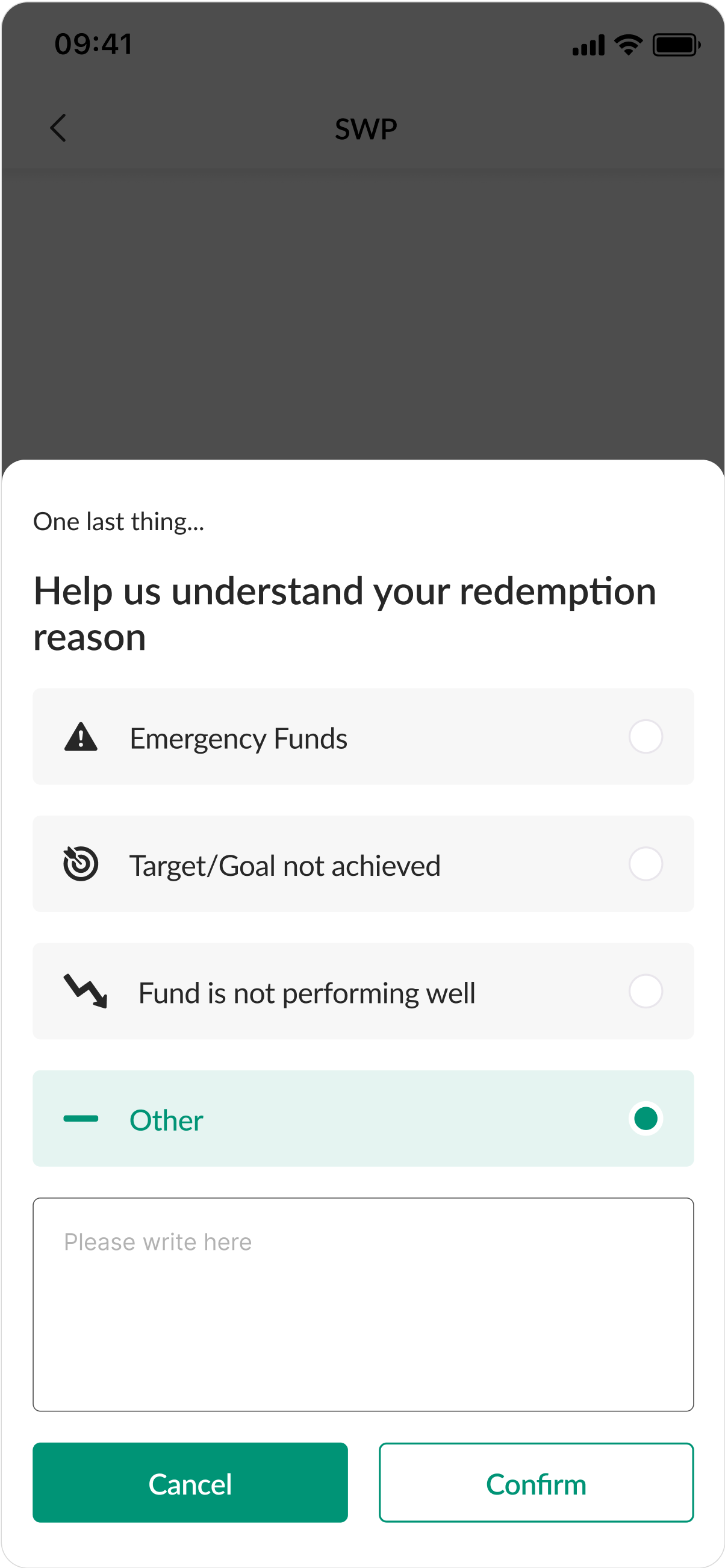

6. User Interaction Flow

- Triggering the Nudge: User clicks Place Order. System evaluates predefined conditions for applicable nudges.

- Displaying Nudges: Nudges are shown in a sequential popup format with a progress bar if multiple nudges apply. Users can interact with CTAs or skip all nudges.

- Completion: Once nudges are completed or skipped, the user proceeds to the final confirmation screen.

7. Implementation Details

- Technology Stack: Integrated with Mint’s backend for dynamic logic updates.

- Testing: Conducted usability tests with 50+ users to refine nudge content and interaction flow. Iterated on design elements like skip buttons and progress indicators based on feedback.

8. Impact and Metrics

- User Engagement: 80% of users interacted with at least one nudge. 30% of users updated Aadhaar links or nominee details post-nudge.

- Feature Adoption: Goal Planner usage increased by 25%. Loan Against MF inquiries rose by 40%.

- User Feedback: Positive responses to the progress bar and skip options. Suggestions for more personalized nudges were noted.

9. Reflection and Learnings

- Challenges: Balancing the relevance of nudges without overwhelming users. Ensuring the skip option didn’t dilute the nudge's importance.

- Learnings: Progress bars improve user trust by indicating nudge sequence. Clear, actionable CTAs increase follow-through rates.